|

|

15 September 2022 Ether goes to proof-of-stake |

| LMAX Digital performance |

|

LMAX Digital volumes dipped back down on Wednesday. Total notional volume for Wednesday came in at $375 million, 18% below 30-day average volume. Bitcoin volume printed $263 million on Wednesday, exactly on point with 30-day average volume. Ether volume really took a dive with traders into cautious mode ahead of Merge day, coming in at just $71 million, 53% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,801 and average position size for ether at 2,668. Volatility has been absent from the market for much of 2022 and is still trending down at yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $983 and $105 respectively. |

| Latest industry news |

|

The long awaited day of the Ethereum Merge has finally arrived and the blockchain will be making its official transition to proof-of-stake. This will likely ramp up the debate around bitcoin versus ether and proof-of-work versus proof-of-stake, but as of now, price action has been quite tame. We believe most of the event risk has already been well anticipated and priced in the lead up, which could leave the balance of risk tilted to the downside over the coming sessions. If everything goes off smoothly, it will be what was expected leaving little additional room for buying on the news, thereby exposing ether to some selling on the fact. And if there are any signs of disruption or bumps, it will almost certainly lead to some selling. But the reality right now, is that the Merge has been overshadowed by developments in global markets, with crypto still trading more on risk sentiment and the outlook for Fed policy than anything else. This week’s hotter than expected US inflation data triggered a new round of risk liquidation and has clearly weighed on crypto as a consequence. So while we could see some volatility around the Merge, provided there are no disasters, we believe the market will quickly get past the event and focus back on the bigger picture macro themes. |

| LMAX Digital metrics | ||||

|

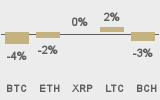

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

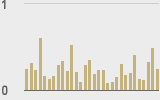

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||