|

|

17 February 2022 Ether volume climbs, bitcoin volume holds steady |

| LMAX Digital performance |

|

LMAX Digital volume has mostly held steady this week, though we have seen more activity around ether. Total notional volume for Wednesday came in at $886 million, 4% above 30-day average volume. Bitcoin volume printed $371 million on Wednesday, 17% below 30-day average volume. Ether volume came in at $456 million, 52% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,565 and average position size for ether at 6,166. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $1,886 and $191 respectively. |

| Latest industry news |

|

Price action was looking rather promising this week, with both bitcoin and eth in demand and fast approaching key short-term resistance levels that if broken, would have opened up a lot more bullish momentum. Yet into Thursday, the picture has soured a bit, with the rallies stalling out and keeping the overall pressure on the downside. At the moment, there haven’t been any major updates on the news side, and it’s mostly a wait and see game. Most of the triggers for bigger moves in the space have been coming from volatility in traditional financial markets. The primary driver of price action in 2022 has been around Fed expectations and how the central bank will respond to rising inflation. As things stand, correlations between crypto and global risk sentiment are still relevant. And so, if we see renewed downside pressure on stocks, it could open another wave of downside pressure in crypto given the fact that many still see crypto as a risk correlated, emerging asset class. If there’s one interesting update this week, it’s the surge in the price of gold to fresh multi-month highs. Gold is used as a classic inflation hedge and has been benefitting from current market conditions as a consequence. But bitcoin also shares those same properties as an inflation hedge and it will be worth paying attention to this to see if we start seeing support for bitcoin on this inflation hedge flow. |

| LMAX Digital metrics | ||||

|

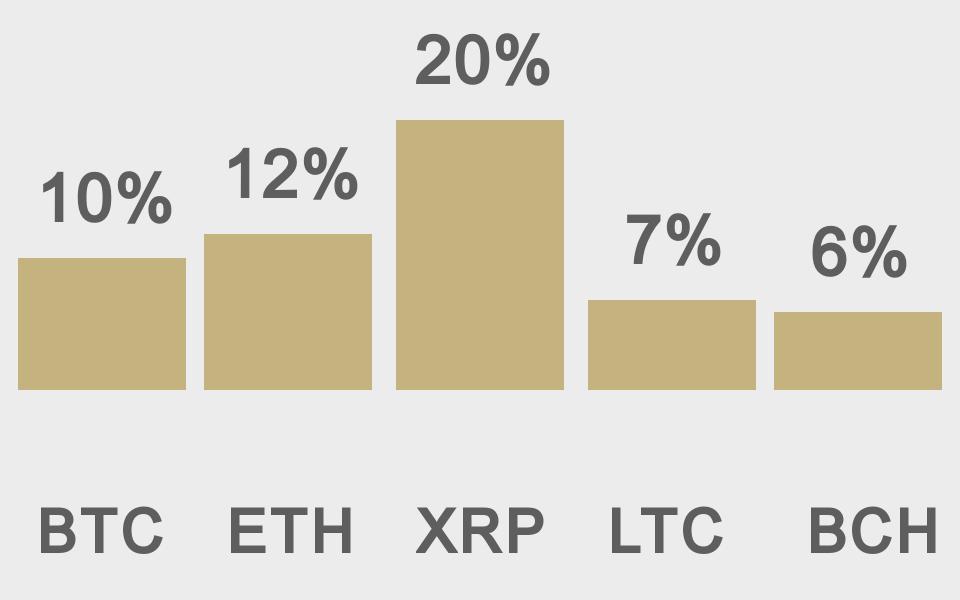

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

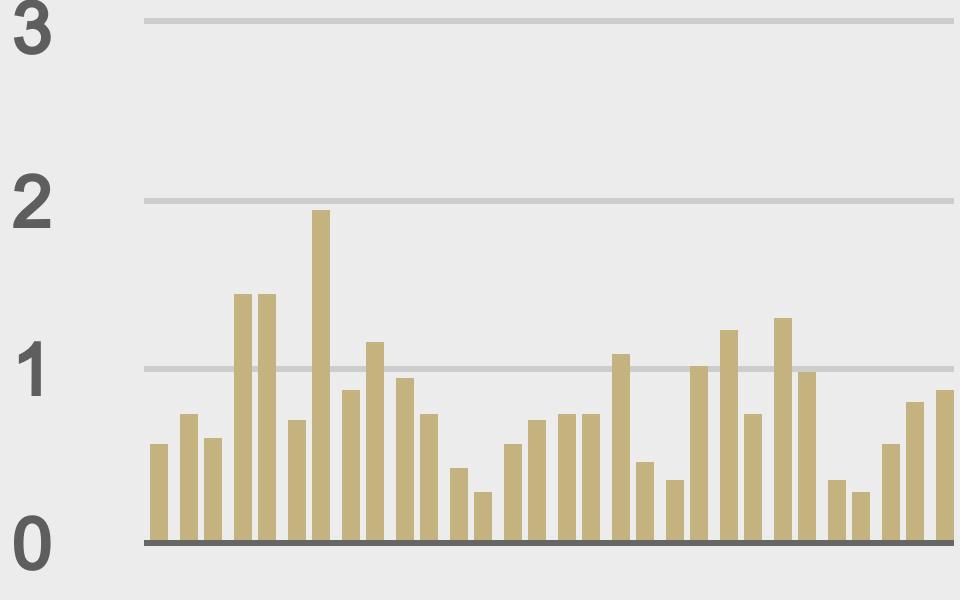

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

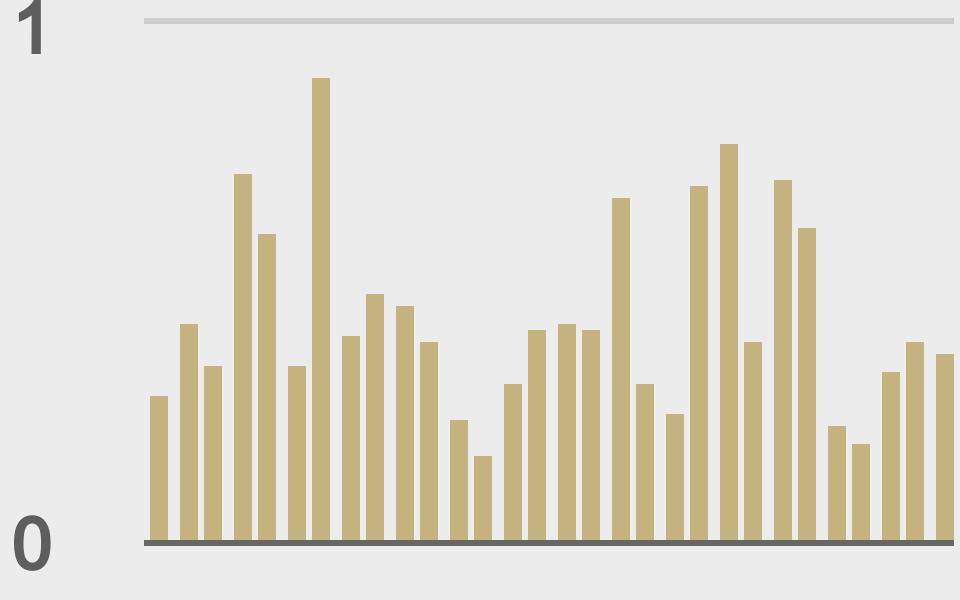

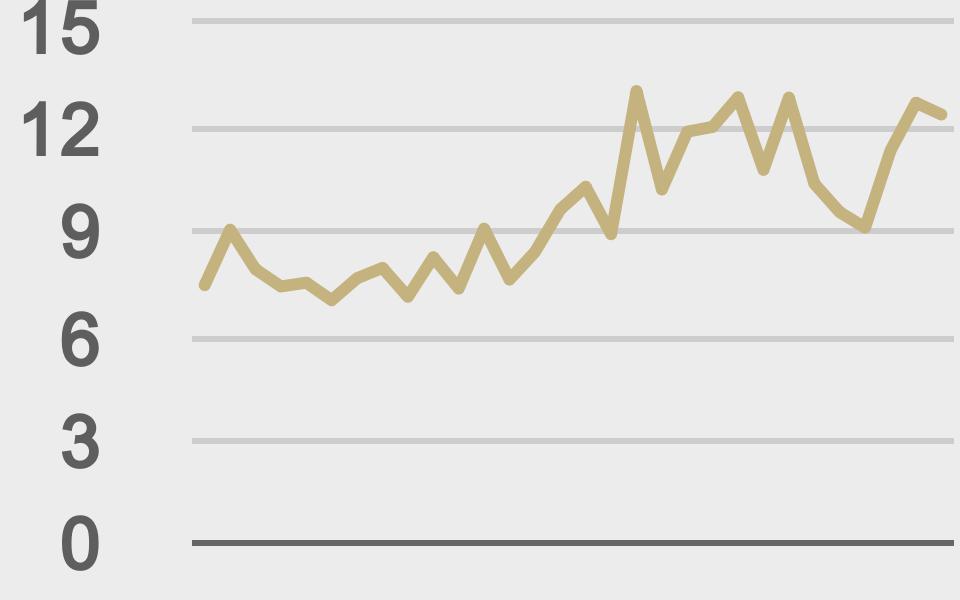

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@zhusu |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||