|

|

15 January 2024 Ether volume shines bright |

| LMAX Digital performance |

|

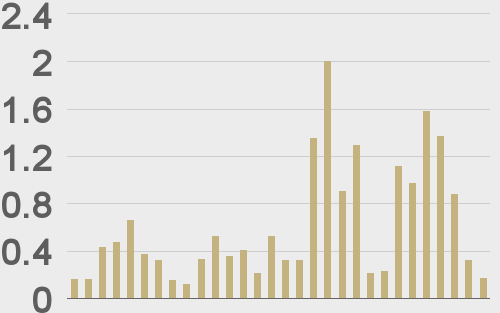

Total notional volume at LMAX Digital was very strong in the previous week, getting a big boost from a surge in ether activity. Total notional volume from last Monday through Friday came in at $7.9 billion, 14% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $6 billion in the previous week, 1% higher than the week earlier. Ether volume came in at $1.3 billion, 90% higher than the week earlier. Total notional volume over the past 30 days comes in at $24.1 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $16,163 and average position size for ether at $4,045. Volatility is tracking just off multi-month highs set in the previous week. We’re looking at average daily ranges in bitcoin and ether of $2,110 and $123 respectively. |

| Latest industry news |

|

There has been an unquestionable wave of ‘sell the fact’ price action in the aftermath of the SEC bitcoin ETF approvals. The pullback in price should therefore come as no surprise to market participants, with dips seen as formidable opportunities to increase exposure. As per our technical insights, setbacks in the price of bitcoin should be very well supported ahead of $40k in favor of the next major upside extension beyond the recent multi-month high and through the next big barrier at $50k. We suspect there could be a period of time between the launch of the bitcoin ETFs and more active adoption from traditional market participants, which would also account for the slowdown in price appreciation. At the same time, it’s worth taking a look at how ether has outperformed bitcoin over the past week, as this reflects more optimism around the crypto asset class. The crypto market is now feeling really good about the outlook for the space and has begun to price in ether spot ETF approvals in the months ahead. On the macro front, there has been some concern that an extended equities market could be at risk of turning lower, which might then weigh on crypto assets. But we’re not convinced this correlation is as relevant as it once may have been. Now that bitcoin has established itself as a more credible asset in the global arena, market participants may start to better understand bitcoin’s value proposition as a flight to safety asset given its extreme limited supply. What this means is that in any period of intense downside pressure on stocks, there could be additional demand for bitcoin in the same way we see demand for the US Dollar and gold in periods of risk liquidation. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||