|

|

13 September 2022 Ethereum Merge event risk looks to be priced in |

| LMAX Digital performance |

|

LMAX Digital volumes traded higher overall on Monday. Total notional volume for Monday came in at $495 million, 12% above 30-day average volume. Bitcoin volume printed $337 million on Monday, 35% above 30-day average volume. Ether volume came in at $112 million, 27% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,752 and average position size for ether at 2,733. Volatility is still struggling to show signs of picking back up. We’re looking at average daily ranges in bitcoin and ether of $857 and $98 respectively. |

| Latest industry news |

|

The latest price action would suggest that a lot of the bullishness around the upcoming Ethereum upgrade has been all but baked into the market. A closer look at the price of ether relative to bitcoin proves this point, with the rate rolling over quite intensely after pushing up to a yearly high. There has been a lot of talk about a bottom in the crypto market in light of this latest recovery. But we’re not convinced. Fundamentally, we still contend there is more fallout to be had in the US equity market, and that the fallout there will open more downside pressure on crypto assets. We also anticipate more bumps ahead on the regulatory front as the market is forced to contend with what exactly is defined as a security. And we definitely anticipate shorter-term bumps in the aftermath of even a smooth Ethereum Merge. Technically speaking, there has been absolutely no change to the outlook. The recent bounce we’ve seen is still nothing more than a correction within what is a very clear downtrend. This translates to the probability of a lower top and fresh downside extension to new yearly lows in crypto. On a positive note, we do believe we are getting closer to a bottom in crypto assets. But we still think we could see one more decent drop, before finally getting that long overdue bounce leading to an eventual retest and break of the record highs. |

| LMAX Digital metrics | ||||

|

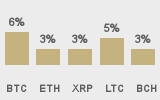

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

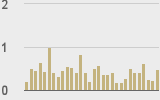

Total volumes last 30 days ($bn) |

||||

|

||||

|

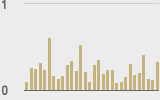

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

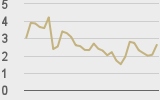

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||