|

| 16 September 2025 Fed meeting looms with high bar for dovish surprise |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a solid start this week. Total notional volume for Monday came in at $604 million, 17% above 30-day average volume. Bitcoin volume printed $226 million, 1% below 30-day average volume. Ether volume came in at $205 million, 14% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,641 and average position size for ether at $3,538. Bitcoin volatility has sunk to its lowest levels of the year. ETH volatility has been in cool down mode since mid-August when it traded to its highest level since December 2021. We’re looking at average daily ranges in bitcoin and ether of $2,364 and $183 respectively. |

| Latest industry news |

|

The crypto market has been broadly steady over the past 24 hours, with total capitalization holding above the USD 4 trillion mark and trading volumes firm. Bitcoin continues to act as the primary barometer of sentiment, trading in a relatively tight range as institutional dip-buying offsets light profit-taking. Ethereum has come under a little more pressure but has found demand on dips, supported by sustained ETF inflows, its yield-generating characteristics, and ongoing Layer-2 network growth that reinforce its long-term adoption story. Attention is increasingly shifting to Wednesday’s Federal Reserve decision, where markets are leaning toward a more accommodative stance in the wake of soft labor market data. The recent appointment of Governor Miran, viewed as favoring a gradual but steady easing path, has strengthened expectations for a dovish outcome. A policy signal that meets or exceeds these expectations would likely pressure the U.S. dollar lower and support risk assets broadly, offering fresh tailwinds for both bitcoin and ether. That said, the bar for a positive surprise is now high. With aggressive Fed easing already priced in, any indication that the Committee is less dovish than anticipated could disappoint markets, lifting yields and weighing on equities and crypto alike. Beyond the Fed, global political factors remain a secondary consideration. Middle East tensions, while ongoing, have not materially altered risk appetite, and crypto markets continue to look through these headlines. Instead, investors remain focused on central bank policy as the dominant driver of near-term direction, with bitcoin and ethereum both poised to react to the tone of the Fed’s announcement and guidance. Overall, crypto’s underlying structure remains supportive, but with expectations for monetary easing now elevated, the next leg of the rally likely hinges on the Fed delivering a decisively dovish message. A softer policy path would reinforce the medium-term bullish case, while a letdown could spark a bout of profit-taking across digital assets. |

| LMAX Digital metrics | ||||

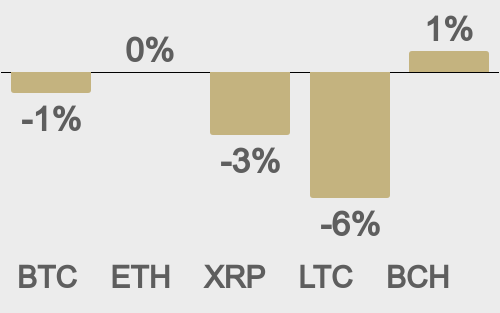

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

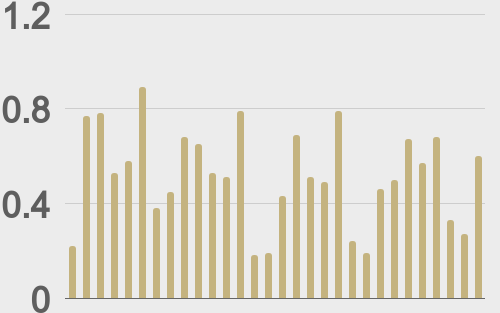

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

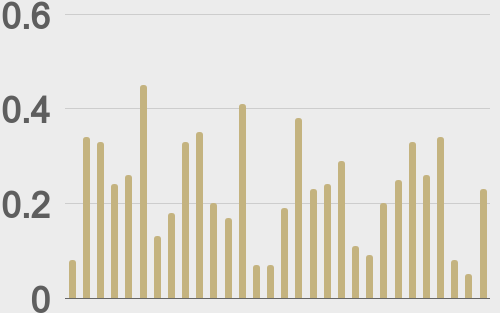

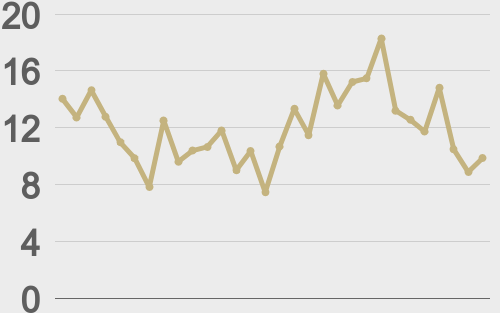

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

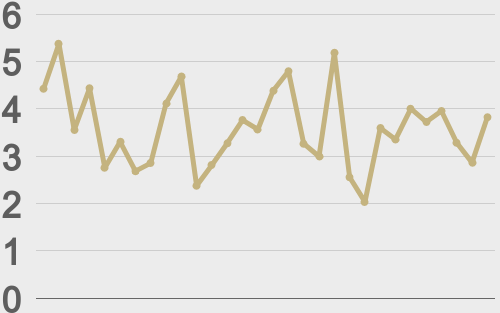

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||