|

|

10 June 2024 Fed repricing weighs on crypto as the week gets going |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $2.2 billion, 42% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $1.3 billion, 104% higher than the previous week. Ether volume came in at $540 million, 18% lower than the week earlier. Total notional volume over the past 30 days comes in at $11.4 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,904 and average position size for ether at $3,705. Market volatility continues to trend lower since peaking in March. We’re looking at average daily ranges in bitcoin and ether of $1,947 and $132 respectively. |

| Latest industry news |

|

The crypto market has been more inclined to be wanting to sit tight than anything else right now. Bitcoin hasn’t been wanting to do much at all since pushing to a fresh record high in March, instead opting to play a game of consolidation. At the same time, setbacks have been exceptionally well supported on the expectation we will soon see the start to the next big push towards the $100,000 barrier. Right now, we’re in a bit of a lull after the early 2024 run on the bitcoin spot ETF approvals and bitcoin halving event. The approval of the ETH spot ETFs has been a major positive, but these products have yet to officially launch. This leaves the crypto market looking elsewhere, and that elsewhere is into the world of traditional financial markets. The big question for traditional markets is how exactly things will play out with the rates outlook. Investors have been hoping for a continued push towards more investor friendly, accommodative monetary policy. This expectation has been supportive of crypto assets overall as it is an expectation that translates to a lower US Dollar across the board. However, it’s possible the downside pressure we’re seeing on crypto assets into Monday is coming from a resurgence in US Dollar demand after the US jobs report came in much stronger than expected, forcing investors to reconsider rate cut bets. What had been an expectation for two full rate cuts ahead of the US jobs report has now been cut down to just 36 basis points of rate cuts priced in 2024. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

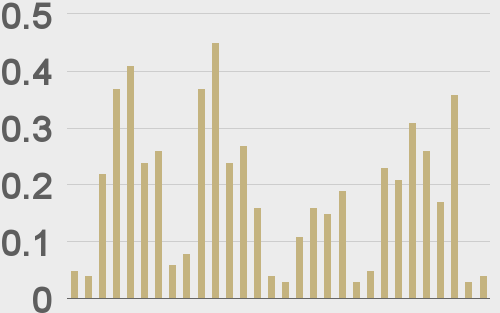

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@pythianism |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||