|

| 12 June 2025 Geopolitics versus bullish trends |

| LMAX Digital performance |

|

LMAX Digital volumes remained healthy overall on Wednesday. Total notional volume for Wednesday came in at $519 million, 16% above 30-day average volume. Bitcoin volume printed $219 million, 6% above 30-day average volume. Ether volume came in at $145 million, 24% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,793 and average position size for ether at $3,244. Bitcoin volatility is still tracking just off recent yearly lows, while ETH volatility has picked up since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $2,807 and $132 respectively. |

| Latest industry news |

|

The crypto market has come under some pressure over the past 24 hours, with a lot of the fallout believed to be driven off escalating geopolitical tensions. This downturn aligns with a broader sell-off in risk assets, driven by fears of an Israeli strike on Iran’s nuclear facilities and US personnel pullbacks in the region. However, these fears may be temporary, with market sentiment anticipating a de-escalation that could redirect attention to positive developments. The Senate’s recent approval of the GENIUS Act mandating 1:1 stablecoin reserves and offering regulatory clarity, stands as a significant tailwind, bolstered by $70 billion in spot ETF inflows. Adding to the bullish case, the softer-than-expected US CPI data for May, released yesterday, provides a positive headwind for risk assets. With headline inflation coming in below forecast and core measures easing, the data has fueled expectations of Fed rate cuts—now pricing in 51 basis points by year-end—weakening the US Dollar to a 1.5-month low. This USD softness typically benefits crypto, supporting a potential rebound in bitcoin and ETH as investors rotate back into riskier assets. Looking ahead, the upcoming US PPI data and geopolitical developments in the Middle East will be critical, but the combination of the GENIUS Act’s progress and a weaker Dollar could drive crypto recovery if Iran-related risks subside. |

| LMAX Digital metrics | ||||

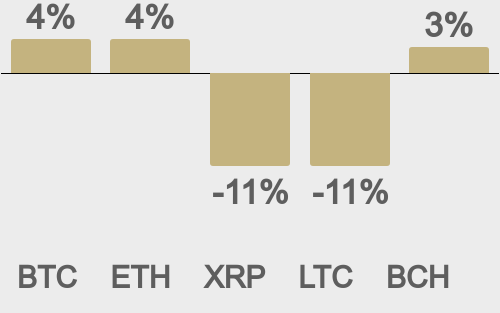

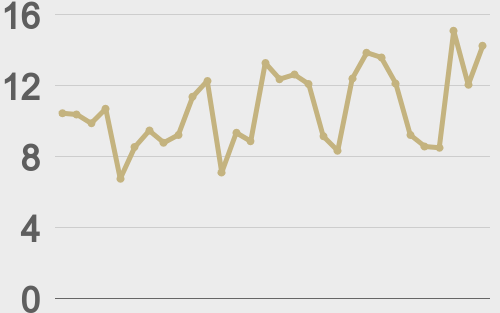

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

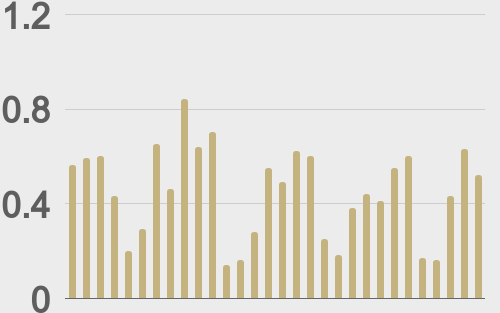

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

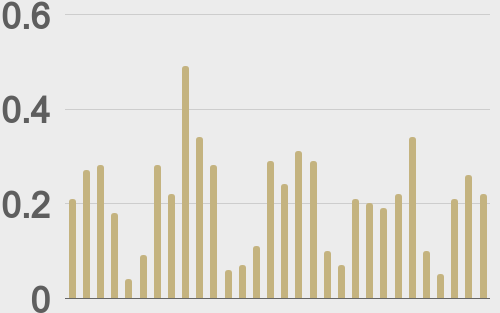

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

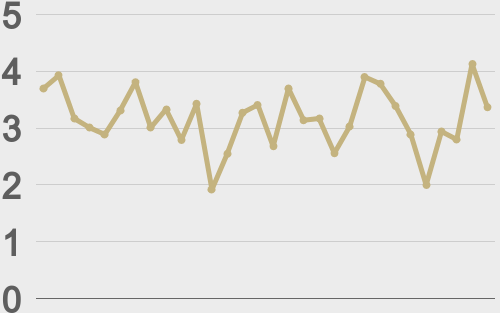

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||