|

|

12 December 2022 Getting closer to major inflection point |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was off in the previous week, suffering from an ongoing tight consolidation. Total notional volume from last Monday through Friday came in at $858 million, 24.48% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $480 million in the previous week, off 28.84% from a week earlier. Ether volume came in at $172 million, 33.93% lower from the week earlier. Total notional volume over the past 30 days comes in at $5.43 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $3,133 and average position size for ether at $1,663. Volatility has been anemic in 2022, and after seeing a little pick-up in recent weeks, we’re right back down to yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $442 and $56 respectively. |

| Latest industry news |

|

Indeed, total notional volume in the crypto market has been discouraging. At the same time, we’re getting to levels where things have lightened up so much, that the expectation should be for there to be a surge in volume on the horizon. This view is derived from the expectation that we should soon see a surge in volatility in the crypto market on account of technical indicators showing such a contraction in volatility that this type of contraction is often indicative of behavior ahead of a big turnaround. At the same time, conditions remain challenging, with crypto traders contending with global macro risk off forces from higher inflation and less investor friendly monetary policy, and also contending with fallout from all of the crypto implosions, worry around more fallout and worry around overly aggressive regulatory crackdowns. As far as the week ahead goes, there is plenty of event risk on the docket that could have an impact on the outlook for crypto. Those events include tomorrow’s US CPI print, and central bank decisions later in the week from the Fed, BOE, and ECB. Technically speaking, we remain confined to a downtrend with bitcoin recently breaking down to a fresh yearly low exposing deeper setbacks towards $10k. Back above resistance at $17,500 would be required at a minimum to take the immediate pressure off the downside. |

| LMAX Digital metrics | ||||

|

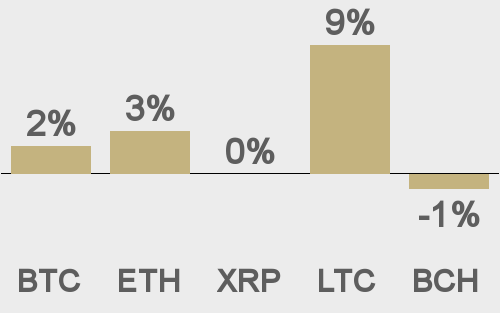

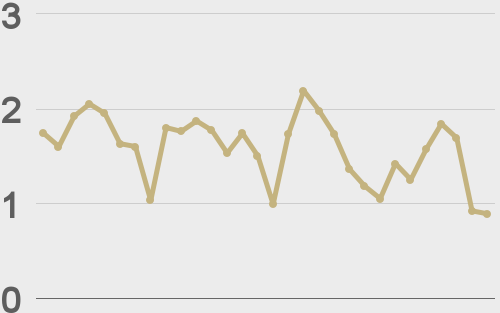

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

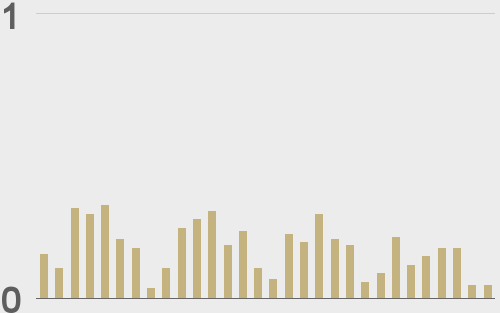

Total volumes last 30 days ($bn) |

||||

|

||||

|

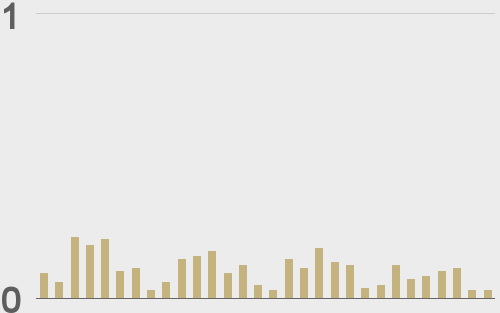

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

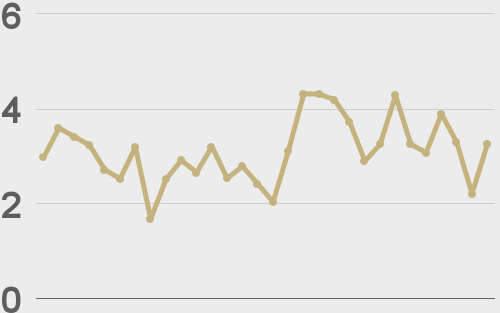

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CryptoKaleo |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||