|

| 6 August 2025 Holding the line in cautious summer trade |

| LMAX Digital performance |

|

LMAX Digital volumes were light on Tuesday, presumably on account of thinner summer trading conditions. Total notional volume for Tuesday came in at $323 million, 48% below 30-day average volume. Bitcoin volume printed $126 million, 56% below 30-day average volume. Ether volume came in at $88 million, 45% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,867 and average position size for ether at $2,934. Bitcoin volatility continues to track just off yearly low levels. ETH volatility has been trending up since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $2,596 and $175 respectively. |

| Latest industry news |

|

Bitcoin has eased modestly over the past 24 hours. The minor pullback comes alongside heavy derivatives activity, with short-term leveraged positions liquidated after price action nudged against key technical levels. Sentiment remains cautious, hovering in the neutral zone, as traders weigh whether current support can hold or if a deeper retracement is ahead. Ethereum has tracked lower in sympathy. A record $465 million in spot ETH ETF outflows has also weighed on market confidence. At the same time on‐chain indicators such as rising on‐balance volume suggest quiet accumulation. Traditional markets have provided little relief. Softer U.S. jobs and services data has fanned concerns over slowing growth, with stagflation fears lingering despite growing expectations for a September Fed rate cut. Geopolitical tensions continue to add to uncertainty. Escalating U.S.–China tariff measures and broader trade friction are filtering through to investor positioning across asset classes, crypto included. Meanwhile, regulatory developments such as U.S. discussions of a strategic Bitcoin reserve and evolving stablecoin frameworks underline both the sector’s increasing integration into policy discourse and the potential for sudden shifts in the rules of engagement. Overall, crypto markets are in a consolidation phase in thinner summer conditions. Near‐term direction will likely hinge on whether macro data reinforces the case for easier policy and whether geopolitical risks cool, providing room for risk assets to recover. |

| LMAX Digital metrics | ||||

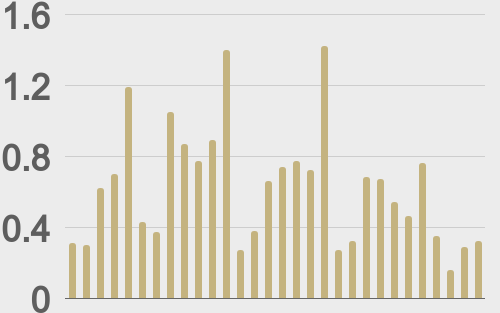

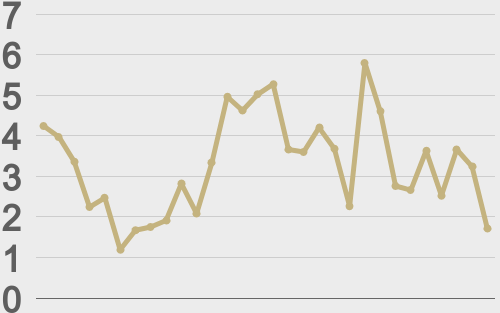

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

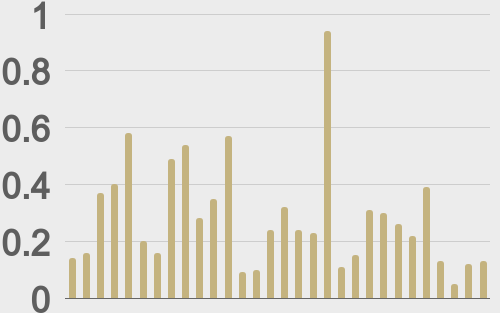

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

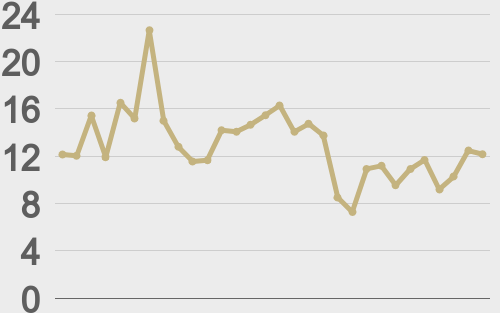

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||