|

|

21 February 2023 Impressive volume in holiday trade |

| LMAX Digital performance |

|

LMAX Digital volumes were up on Monday despite the thinner conditions from the US holiday. Total notional volume for Monday came in at $481 million, 33% above 30-day average volume. Bitcoin volume printed $267 million on Monday, 42% above 30-day average volume. Ether volume came in at $117 million, 10% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,261 and average position size for ether at 3,019. Volatility has cooled from recent peaks, but overall, has turned up a good deal from multi-month lows we were seeing in 2022. We’re looking at average daily ranges in bitcoin and ether of $871 and $70 respectively. |

| Latest industry news |

|

We didn’t see much in the way of any fresh direction on Monday. However, it was encouraging to see volume trading up despite the thinner market conditions on account of the US holiday. At the moment, there has been more good than bad when it comes to headlines in the crypto space, which has helped to keep these markets well supported into dips. For the most part, we feel the stories around ongoing institutional adoption are the most important with respect to driving confidence in the asset class, as it shows longer-term commitment from serious players. Technically speaking, bitcoin is consolidating below critical resistance in the form of the August 2022 high. We’ll need to see the market establish back above this level which comes in at $25,220 to further encourage the recovery outlook. Until then, there is risk that we see more short-term turbulence leading to another pullback. Fundamentally, the market is still contending with the risk of a meltdown in US equities from less investor friendly monetary policy. While we don’t believe correlations with the stock market are relevant longer-term, in the short-term, there is still the possibility that if we do see stocks melting down, it could trigger another wave of downside pressure on crypto. |

| LMAX Digital metrics | ||||

|

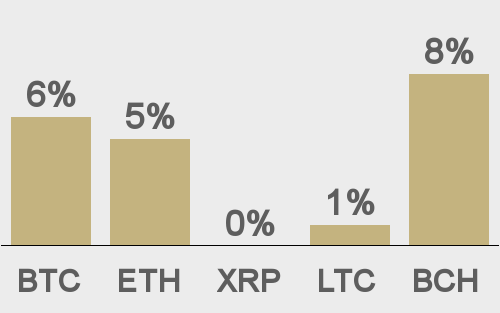

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

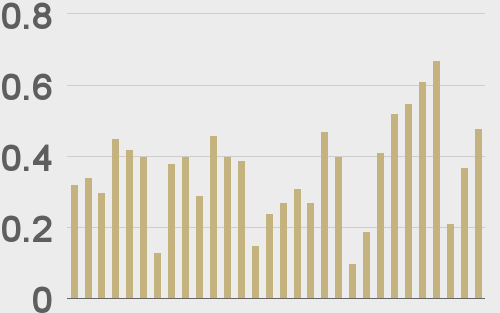

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

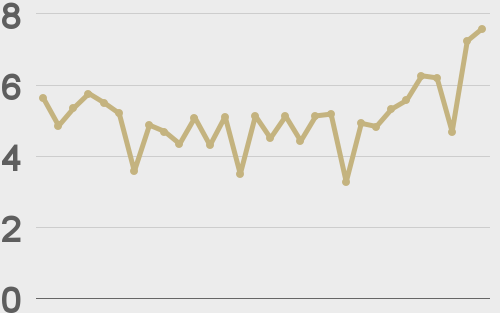

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

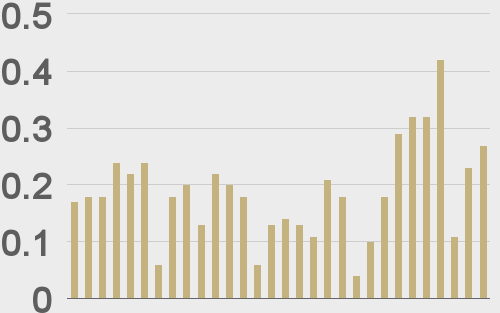

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

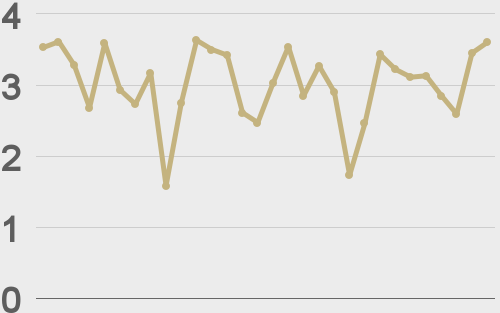

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||