|

| 8 September 2025 Institutions keep buying dips |

| LMAX Digital performance |

|

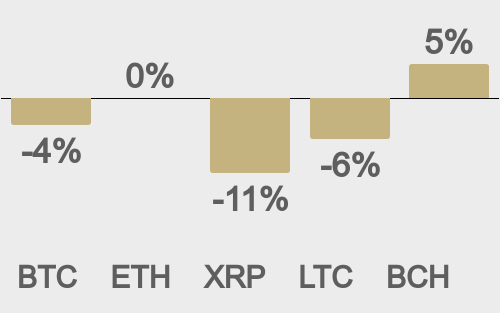

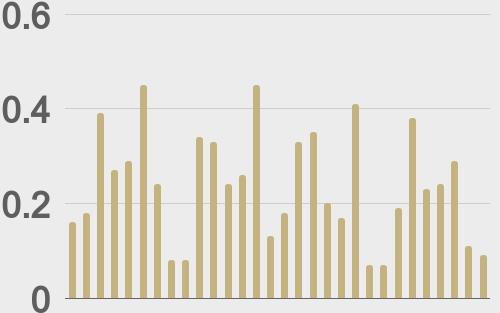

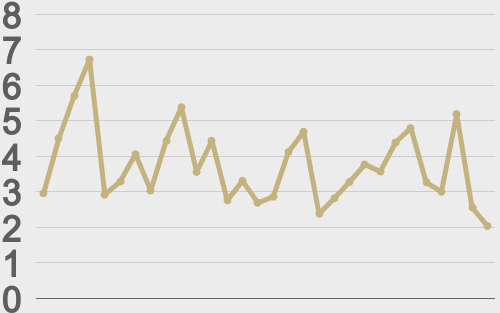

Total notional volume from last Monday through Friday came in at $2.9 billion, 8% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.3 billion, 10% lower than the previous week. Ether volume came in at $1 billion, 2.5% lower than the week earlier. Total notional volume over the past 30 days comes in at $17 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,852 and average position size for ether at $3,572. Bitcoin volatility continues to consolidate off yearly low levels. ETH volatility has been in cool down since recently hitting its highest level since December 2021. We’re looking at average daily ranges in bitcoin and ether of $2,695 and $203 respectively. |

| Latest industry news |

|

The cryptocurrency market has exhibited modest resilience over the past 24 hours. As the primary proxy for broader market sentiment, bitcoin’s gain reflects dip-buying from institutional players, including treasury firms like Strategy. We had seen some mild downside pressure in recent days, particularly on the back of geopolitical risks highlighted by Israel-Iran frictions, but ultimately, the market has done a good job shrugging this off. ETH has also been well in demand on the back of robust ETF inflows which continue to provide a supportive floor despite short-term outflows. Overall crypto market capitalization hovers near $3.9 trillion, underscoring the ongoing rotation toward crypto assets. Ethereum’s performance has also been buoyed by its appeal as a yield-generating asset amid Layer-2 expansions. DeFi lending volumes have doubled year-to-date, while tokenized U.S. stocks have expanded access for emerging markets, blending TradFi with blockchain. From traditional markets, the latest softer round of US jobs data has reaffirmed the prospect for more Fed rate cuts than less, something that is almost always a benefit for crypto assets. Finally, the U.S. Senate’s draft bill exempting staking and airdrops from securities classification, alongside the GENIUS Act’s stablecoin guardrails, continues to foster optimism for innovation within crypto. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||