|

|

23 October 2024 Latest stumble to be taken with a grain of salt |

| LMAX Digital performance |

|

LMAX Digital volumes were relatively flat on Tuesday. Total notional volume for Tuesday came in at $295 million, 4% above 30-day average volume. Bitcoin volume printed $174 million on Tuesday, 1% above 30-day average volume. Ether volume came in at $52 million, 17% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,439 and average position size for ether at $2,943. Market volatility continues to trend lower overall since peaking earlier this year. We’re looking at average daily ranges in bitcoin and ether of $1,843 and $92 respectively. |

| Latest industry news |

|

Crypto price action has faltered into the mid-week though it’s important to take the price action with a grain of salt. We haven’t seen too much on the fundamental front that would account for the recent weakness, with only a snapped string of consecutive daily inflows into the bitcoin spot ETFs of note. Macro headwinds could perhaps be playing into the equation a bit given the ongoing demand for the US Dollar. As yield differentials move back to the Buck, currencies trade lower across the board. But if we can see the forest through the trees, the outlook continues to look exceptionally bright. Look no further than YTD performance in the price of bitcoin, up 58%, far outpacing the record performance in gold and the S&P500. Indeed, the yellow metal has been on the move into uncharted waters, which makes sense at a time when central banks are moving back into accommodation mode. This is why we believe bitcoin has outpaced even gold, with bitcoin quite arguably a more attractive hedge against inflation. After all, bitcoin is even more scarce than gold and carries with it plenty of other advantages including ease of transfer, cost of transfer, decentralization, and network security. Moving on, it’s worth highlighting another impressive update for crypto this week. That update comes from the news of Stripe’s acquisition of stablecoin platform Bridge for $1.1 billion. The acquisition proves crypto’s concept all the more as it will enable Stripe to offer a more attractive, instant, low-cost settlement through stablecoins. |

| LMAX Digital metrics | ||||

|

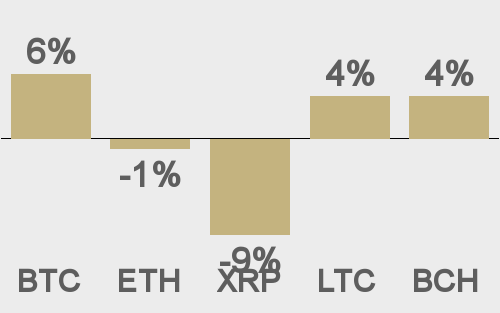

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

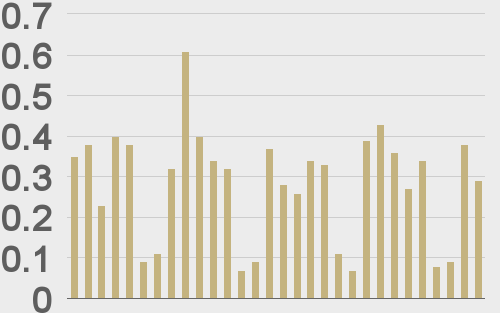

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

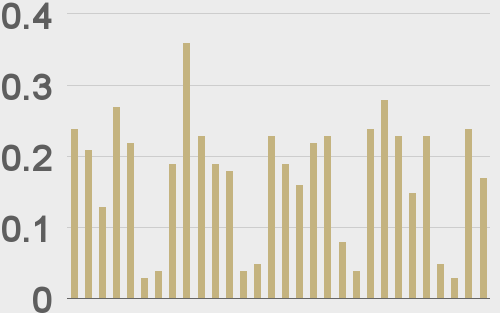

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

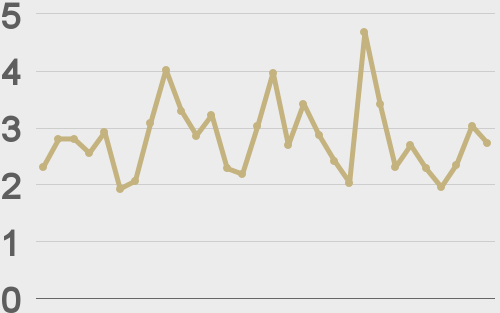

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||