|

| 17 September 2025 Long-term structural tailwinds offset near-term Fed risk |

| LMAX Digital performance |

|

LMAX Digital volumes were solid again on Tuesday. Total notional volume came in at $594 million, 12% above 30-day average volume. Bitcoin volume printed $230 million, 2% below 30-day average volume. Ether volume came in at $198 million, 8% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,698 and average position size for ether at $3,553. Bitcoin volatility has sunk to its lowest levels of the year. ETH volatility has been in cool down mode since mid-August when it traded to its highest level since December 2021. We’re looking at average daily ranges in bitcoin and ether of $2,346 and $180 respectively. |

| Latest industry news |

|

The crypto market remains well supported, with total capitalization holding well above USD 4 trillion and trading volumes remaining firm. Bitcoin has been better bid as institutional dip-buying offsets light profit-taking, while Ethereum has found demand into pullbacks, supported by sustained ETF inflows, its yield-generating characteristics, and ongoing Layer-2 network growth. Headlines within the sector added to the constructive tone: senior crypto executives joined U.S. lawmakers in Washington to advance a proposed strategic bitcoin reserve bill, and PayPal has announced an upcoming “Links” feature aimed at expanding peer-to-peer crypto payments, both of which underline the gradual institutionalization of digital assets. Macro drivers remain the dominant near-term catalyst, with markets now focused squarely on this week’s Federal Reserve decision. Softer U.S. labor data and the recent appointment of Governor Miran—viewed as supportive of a gradual easing path—have reinforced expectations for a dovish outcome. However, with risk assets already at all-time highs and aggressive Fed cuts largely priced in, the bar for a positive surprise is high. A less-dovish tone could disappoint, triggering a “sell-the-fact” reaction that briefly boosts the U.S. dollar and pressures crypto assets. At the same time, a broader structural narrative continues to provide an important counterbalance. The global monetary system is in flux: concerns over the long-term role of the U.S. dollar as the world’s reserve anchor, a declining share of USD assets in central bank portfolios, and ongoing changes in global payment systems are steadily reshaping the investment landscape. Against this backdrop, the crypto market’s capitalization now amounts to roughly 10% of the combined M1 money supply of the U.S., Europe, and China, highlighting digital assets’ growing relevance in global liquidity terms. In sum, bitcoin and ethereum remain well supported by institutional adoption and macro liquidity trends, but short-term price action will hinge on how the Fed calibrates its message. A decisively dovish signal could extend the rally, while even a mildly less-accommodative stance risks prompting profit-taking before the longer-term structural themes reassert their influence. |

| LMAX Digital metrics | ||||

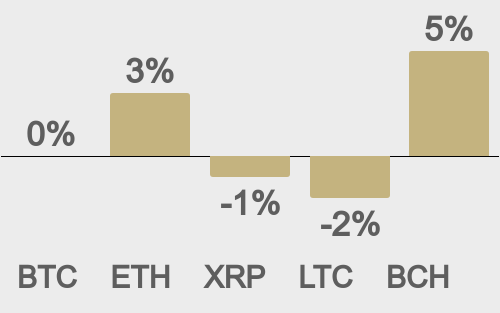

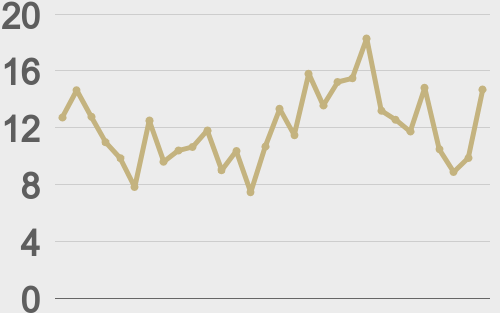

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

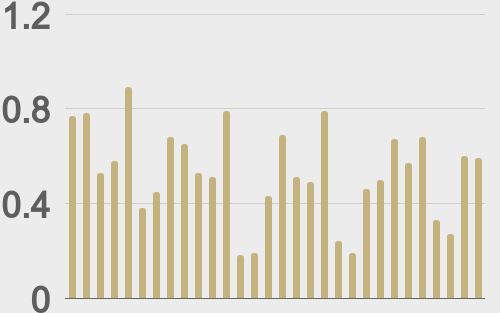

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

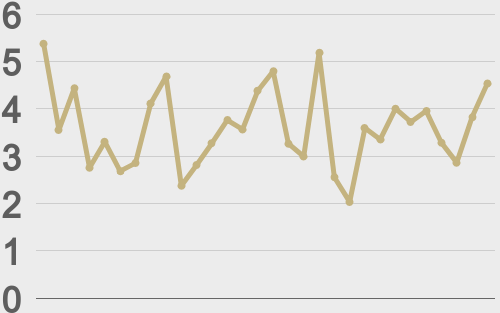

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

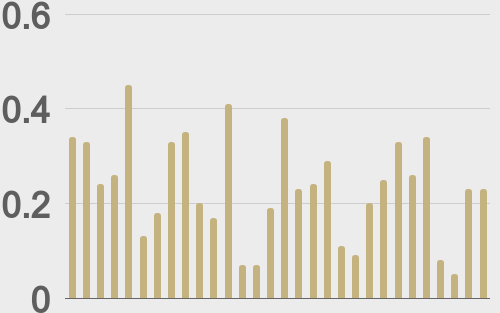

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||