|

|

11 January 2023 Looking ahead to US inflation data |

| LMAX Digital performance |

|

LMAX Digital volumes were up a nice amount on Tuesday, despite coming off from the previous day. Total notional volume for Tuesday came in at $270 million, 39% above 30-day average volume. Bitcoin volume printed $142 million on Tuesday, 23% above 30-day average volume. Ether volume came in at $71 million, 66% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,557 and average position size for ether at 1,904. Volatility is still suppressed at multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $287 and $35 respectively. At the same time, this could be a warning sign of a major surge in volatility ahead. |

| Latest industry news |

|

The short-term technical and fundamental outlook suggests we still could see additional declines in the price of bitcoin before we finally reach bottom. Technically, the November breakdown to a fresh yearly low below $17,600 opens the door for the next major downside extension towards a measured move objective at $10,000. Fundamentally, a combination of risk off flow in traditional markets, more fallout from the crypto implosions of 2022, and worry around regulatory crackdown, could all result in this next wave of downside pressure. However, any additional setbacks below $10,000 are seen as short-lived on the longer-term value proposition, with the greater risk for the formation of a major bottom somewhere in the first half of 2023 ahead of the next big upside extension back towards and through the record high. At the moment, the market is waiting for tomorrow’s US CPI data result, which will have an impact on price action. An above forecast CPI number will likely weigh on the price of bitcoin as it will point to the need for the Fed to be more aggressive with rate hikes, which in turn will move yield differentials in favor of the US Dollar. A below forecast print will argue in favor of the Fed pivot trade and drive yield differentials out of the US Dollar’s favor, which will likely inspire bitcoin demand. |

| LMAX Digital metrics | ||||

|

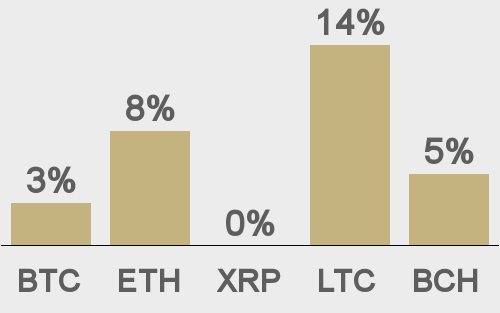

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

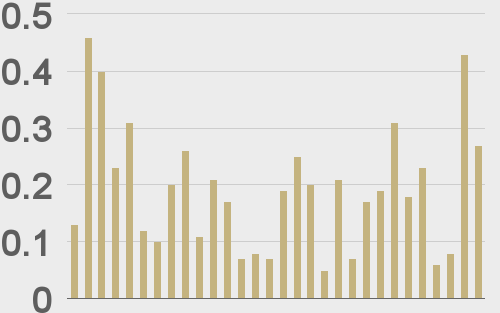

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

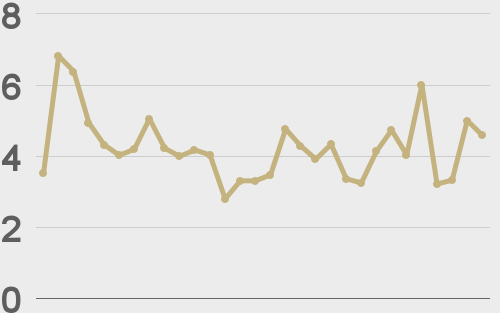

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

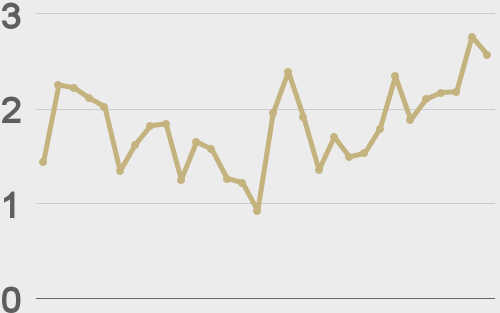

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||