|

| 11 September 2025 Market resilience highlights structural adoption trend |

| LMAX Digital performance |

|

LMAX Digital volumes picked up on Wednesday. Total notional volume for the day came in at $675 million, 20% above 30-day average volume. Bitcoin volume printed $328 million, 36% aboce 30-day average volume. Ether volume came in at $225 million, 7% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,956 and average position size for ether at $3,347. Bitcoin volatility continues to consolidate off yearly low levels. ETH volatility has been in cool down mode since recently hitting its highest level since December 2021. We’re looking at average daily ranges in bitcoin and ether of $2,645 and $189 respectively. |

| Latest industry news |

|

The crypto market has remained well supported over the past 24 hours, keeping total capitalization above the USD 4 trillion mark and volumes firm. Bitcoin remains the key barometer of sentiment, holding its recent range as institutional dip-buying continues to offset sporadic profit-taking. Market participants continue to monitor large holder behavior, with earlier reports of significant whale sales still a background consideration, but price action so far shows resilience. ETH has also performed well, supported by ongoing ETF inflows and its positioning as a yield-generating, utility-driven asset. Robust activity in decentralized finance—where lending volumes have doubled year-to-date—and continued Layer-2 network growth are helping underpin demand. The market’s ability to sustain these flows despite occasional outflows underscores investor confidence in ETH’s longer-term narrative. From the traditional markets side, expectations for U.S. monetary policy remain a dominant driver. Last week’s softer U.S. jobs data reinforced the view that the Federal Reserve is poised to begin easing, with market-implied odds of a September rate cut now fully priced and discussion of a larger initial move still circulating. Today’s U.S. CPI release is the next key test, though even a modest upside surprise may not derail the current easing bias given labor market softness. A weaker U.S. dollar and lower yields continue to support risk appetite across crypto assets. Geopolitical factors are present but have not meaningfully shifted the landscape. Tensions in the Middle East remain on investors’ radar, yet crypto prices have largely shrugged off these concerns in recent sessions. The ability of the market to look through these risks highlights a focus on monetary policy and structural adoption trends as the more immediate catalysts. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

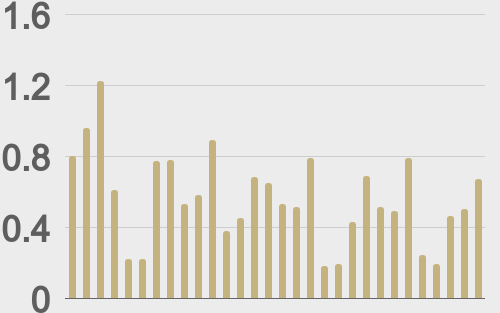

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||