|

| 13 January 2026 Momentum builds ahead of key data |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a solid start this week. Total notional volume for Monday came in at $308 million, 33% above 30-day average volume. Bitcoin volume printed $160 million, 24% above 30-day average volume. Ether volume came in at $82 million, 60% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,508 and average position size for ether at $1,540. Bitcoin and ETH volatility have been trending lower over the past several weeks. We’re looking at average daily ranges in bitcoin and ether of $2,261 and $105 respectively. |

| Latest industry news |

|

Crypto markets trade with a constructive tone over the past 24 hours, consolidating just below key technical resistance as momentum continues to build across majors. Bitcoin remains well supported above the low-$90,000s and is pressing toward the critical $95,000 breakout level, while ETH is coiling below $3,500 — a zone that carries both technical and psychological significance. Price action suggests both assets are forming bullish continuation structures, with dips continuing to attract institutional demand. Flows remain dominated by large-scale accumulation, with Strategy and Bitmine adding to their holdings in fresh purchases that reinforce the balance-sheet adoption narrative. On-chain data continues to point to tightening spot supply as long-term holders remain inactive and exchange balances trend lower. In parallel, Ethereum’s application layer is seeing renewed traction, with over $337 billion now actively deployed across lending, trading and settlement protocols — a powerful signal of real economic activity returning to the network. Regulatory developments in Washington are also helping support sentiment. Former SEC Commissioner Paul Atkins flagged that this will be a “big week for crypto” on the policy front, with multiple bills advancing through Congress aimed at clarifying market structure, custody rules and stablecoin oversight. The direction of travel remains constructive, with bipartisan momentum building toward a more defined regulatory framework that institutions have long been waiting for. From a macro perspective, attention is turning to upcoming US inflation data, which could act as a near-term catalyst for price action. A softer print would reinforce expectations for Fed rate cuts later this year, supporting risk assets and alternative stores of value, while an upside surprise could trigger short-term volatility. The dollar remains a key variable, with any renewed weakness likely to provide a tailwind for crypto. Overall, the market remains technically well positioned for an upside resolution. A sustained break above $95,000 in bitcoin and $3,500 in ETH would likely trigger fresh momentum-driven inflows, opening the door for a renewed leg higher across the broader digital asset complex. The backdrop of improving regulation, growing real-world usage and steady institutional accumulation continues to strengthen the medium-term bull case. |

| LMAX Digital metrics | ||||

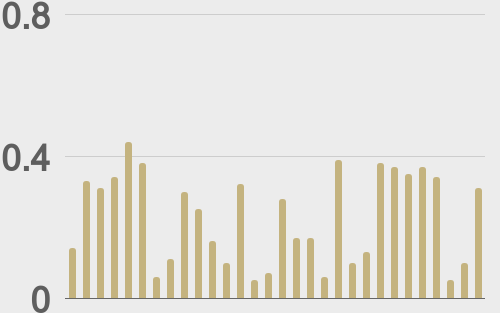

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

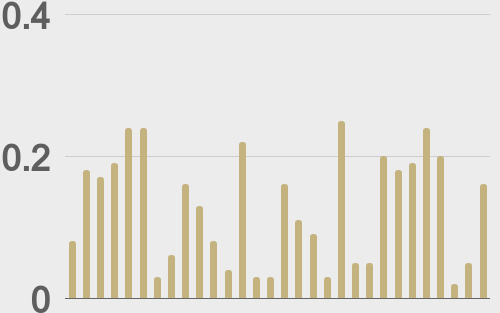

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

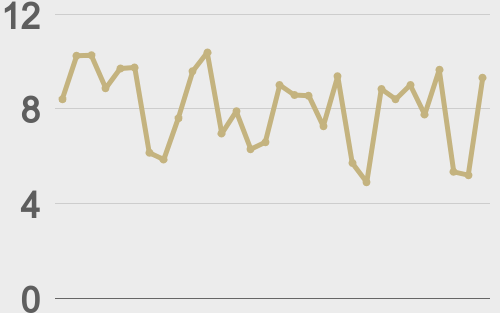

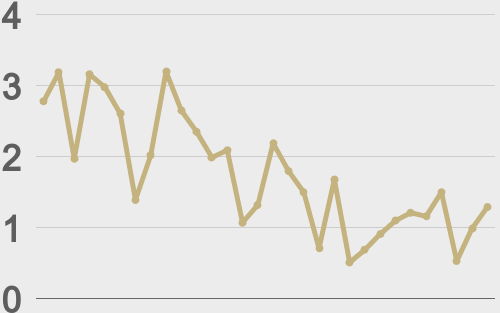

| Average daily range | ||||

|

||||

|

||||

|

@WatcherGuru |

||||

|

@MilkRoad |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||