|

|

2 June 2022 Monthly review |

| LMAX Digital performance |

|

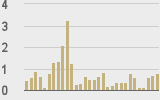

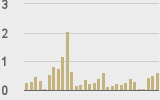

LMAX Digital volume trended back up in May after an anemic April. Total notional volume for May came in at $22 billion, 42% higher than April. Bitcoin volume printed $13.6 billion in May, 55% above April volume. Ether volume printed $5.7 billion in May, 16% above April volume. Total year-to date-volume (through May end) has crossed over the $100 billion mark, coming in at $104 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,480 and average position size for ether at 3,867. We’ve been seeing signs of a pickup in activity, though volatility has been trending lower overall in 2022. We’re now looking at average daily ranges in bitcoin and ether of $1,684 and $144 respectively. |

| Latest industry news |

|

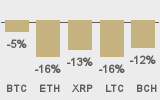

We’re coming out of another ugly month for bitcoin, with the asset extending declines from April and closing out the month down 18%. Year to date, bitcoin is down 36% against the Dollar, and has traded off over 60% from the record high in late 2021. The story for ether is even gloomier. Ether was down 31% in May against the US Dollar. Year to date, ether is down 51% against the Buck, and has traded off as much as 65% from the record high in late 2021. The downturn in crypto assets has been mostly attributed to macro themes, with slower growth and rising inflation stoking fears of global recession and triggering a massive risk liquidation. Given the maturing nature of the asset class, it comes as no surprise to see it trading more like a risk correlated market right now. Having said that, what is clear, is that bitcoin is the safer option within the crypto space, which has easily accounted for bitcoin’s strong wave of relative outperformance against ether and other cryptocurrencies during this downturn. Another driver of crypto weakness in May was the Terra Luna debacle. The collapse in the stable coin led to some $60 billion in losses, inviting more attention around the need for stricter regulatory oversight. Indeed, a regulatory framework is welcome, but there is worry that an event like this could lead to unnecessary and counterproductive overregulation which would ultimately punish the rest of the space and stifle innovation. On a positive note, we believe events like these should be taken as a constructive sign for the space. Ultimately, despite the intense setbacks, the crypto market has held up relatively well to the shock, reflecting an absence of systemic risk. This should be taken as yet another successful stress test as the asset class continues to grow and institutional adoption ramps up. Looking ahead, we continue to see risk for additional downside on account of the global economic outlook and prospect that higher inflation and slower growth will lead to more of a shakeup in risk assets, which will open more downside pressure in crypto. At the same time, we also believe we are getting closer to levels where the longer-term value proposition of crypto will be too difficult to ignore at such discounted prices. Below the respective yearly lows in bitcoin and ether are next key support levels at $20,000 and $1,400 respectively. We think additional setbacks beyond these levels should be short-lived |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||