|

|

24 October 2022 Much talked about correlation is breaking down |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was lower in the previous week. Total notional volume from last Monday through Friday came in at $1.2 billion, 26% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $667 million in the previous week, off 28% from a week earlier. Ether volume came in at $426 million, 20% lower from the week earlier. Total notional volume over the past 30 days comes in at $8.6 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,583 and average position size for ether at $2,496. Volatility is still struggling to show signs of picking back up in 2022. We’re looking at average daily ranges in bitcoin and ether of $572 and $55 respectively. |

| Latest industry news |

|

Crypto assets remain confined to exceptionally thin trade, with bitcoin and ether unwilling to break out of recent ranges. Average daily ranges have sunk to multi-month lows, and volatility is nowhere to be found. Clearly, this has also had a negative impact on volumes. If there is one interesting development to speak of in recent days, it’s that we have seen a disconnect between crypto and correlations with risk assets. Stocks have moved lower and crypto has held up. And stocks have recovered and crypto hasn’t shown any desire to want to move higher with stocks. We believe it is important to see a breakdown in the correlation with traditional risk assets, as it will open the door for market participants to recognize crypto as an attractive diversification option for portfolio allocation. We also believe more adoption will come as we get more regulatory clarity, which seems to be closer and closer to playing out. Technically speaking, we continue to recommend keeping an eye on the bitcoin price and using bitcoin as a proxy for sentiment and direction in the crypto market. The August high and yearly low are the most significant levels to pay attention to. Shorter-term, key resistance comes in at $22,800, while key support sits at $18,130. |

| LMAX Digital metrics | ||||

|

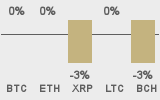

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

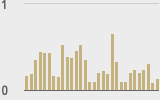

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

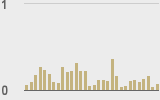

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

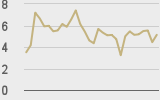

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||