|

| 25 June 2025 Markets pivot as geopolitical tension cools |

| LMAX Digital performance |

|

LMAX Digital volumes put in impressive numbers on Tuesday. Total notional volume for Tuesday came in at $665 million, 49% above 30-day average volume. Bitcoin volume printed $316 million, 53% above 30-day average volume. Ether volume came in at $202 million, 76% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,038 and average position size for ether at $2,913. Bitcoin volatility is slowly turning up from yearly low levels, while ETH volatility has been contained since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $3,057 and $144 respectively. |

| Latest industry news |

|

A tentative ceasefire between Israel and Iran has sparked renewed risk appetite across both crypto and traditional assets. Markets have priced in a clear de-escalation, shifting away from safe-haven trades and favoring growth-sensitive exposures. This geopolitical pivot, combined with softer U.S. macro data, short liquidations and firm institutional flows, have helped to drive a healthy rebound, putting the focus back on fresh record highs for bitcoin and a more meaningful breakout in the price of ETH. Traditional markets have further fueled crypto’s bid, with dovish signals from Fed Governor Bowman and Chicago Fed President Goolsbee increasing expectations for rate cuts as early as July 2025. Weaker-than-expected flash PMI data and a sharp drop in June. Consumer Confidence have also pressured the U.S. Dollar, reinforcing support for cryptocurrencies. Still, Fed Chair Powell’s cautious tone during Senate testimony—especially regarding inflationary risks tied to tariffs— has kept traders wary of over-committing to easing bets. Institutional activity within the digital asset space remains robust. Spot Bitcoin ETF inflows have held firm, with BlackRock’s IBIT leading the pack. Ethereum has seen a 10% increase in on-chain transaction volume, while SharpLink Gaming has built up a sizable ETH treasury (nearly $500 million), reinforcing confidence in the broader market. U.S. states like New Hampshire, Texas, and Arizona have all advanced efforts to build Bitcoin reserves, signaling growing public-sector integration. Meanwhile, the CME Group’s integration of XRP futures has also added depth to the altcoin liquidity landscape. Looking ahead, crypto markets will remain highly sensitive to global political shifts and central bank commentary. European negotiations with Tehran and tariff policy developments in Washington may impact broader risk sentiment. Key macro catalysts include Powell’s continued testimony and the upcoming core PCE inflation data—both of which are expected to heavily influence rate cut pricing and, by extension, crypto’s short-term trajectory. |

| LMAX Digital metrics | ||||

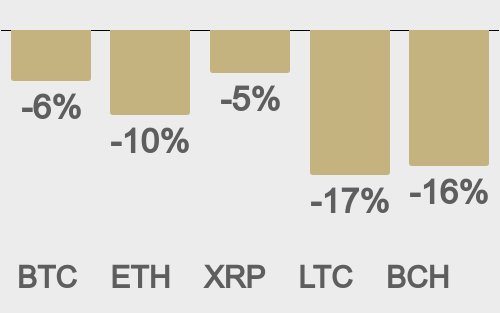

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

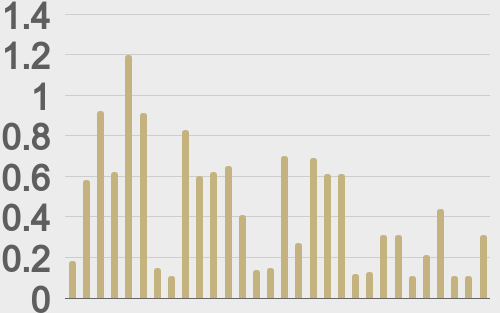

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

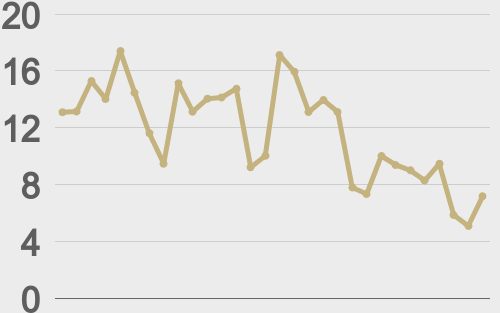

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||