|

| 14 August 2025 Nothing more than profit taking |

| LMAX Digital performance |

LMAX Digital volumes put in their strongest performance since late July, with ETH once again leading the way. Total notional volume for Wednesday came in at $956 million, 53% above 30-day average volume. Bitcoin volume printed $290 million, 10% above 30-day average volume. Ether volume came in at $526 million, 170% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,525 and average position size for ether at $3,258. Bitcoin volatility continues to consolidate off yearly low levels. ETH volatility has been trending higher since bottoming in May, pushing to its highest levels since March. We’re looking at average daily ranges in bitcoin and ether of $2,783 and $204 respectively. |

| Latest industry news |

It comes as no surprise to see a round of profit taking kick in following some impressive moves in crypto markets this week. But overall, the outlook remains highly constructive and dips should be well supported. Bitcoin’s latest push to another record high comes from a healthy wave of positive momentum, largely on the back of a more constructive U.S. regulatory climate—particularly the executive order allowing 401(k) plans to invest in crypto— and easing Fed rate-cut expectations continuing to attract risk appetite into digital assets. Ethereum has outpaced its larger counterpart and is now within a stone’s throw of breaking through the record high from 2021. The ETH outperformance has been driven off a surge of institutional flows, alongside growing treasury accumulation by corporates and steady engagement from ecosystem stewards. Within the broader crypto universe, ETF inflows remain a central force in shaping price dynamics, reinforcing the view that both bitcoin and ether are transitioning from speculative instruments to legitimate stores of value within institutional portfolios. Strategic demand from treasury companies, combined with corporate adoption, is underpinning longer-term price support. Traditional financial markets and geopolitics are lending tailwinds. Global equities are buoyant, the U.S. dollar is under pressure amid growing confidence in Fed rate cuts, and Trump administration policy initiatives—such as the 401(k) crypto investment authorization—are further legitimizing digital assets. Looking ahead, the key risk factors include potential overextension of valuations, geopolitical turbulence, or economic data that could recalibrate Fed projections. That said, institutional momentum and policy support remain firmly in place, providing a robust foundation for continued upside—especially for ETH—with Bitcoin providing steady underpinnings as the mature store-of-value anchor. |

| LMAX Digital metrics | ||||

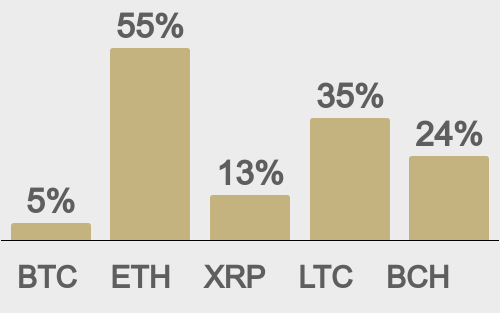

| Price performance last 30 days avg. vs USD (%) | ||||

| ||||

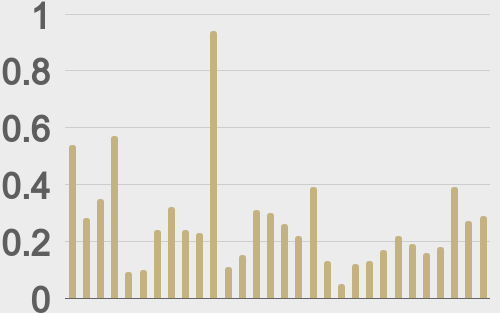

| Total volumes last 30 days ($bn) | ||||

| ||||

| BTCUSD volumes last 30 days ($bn) | ||||

| ||||

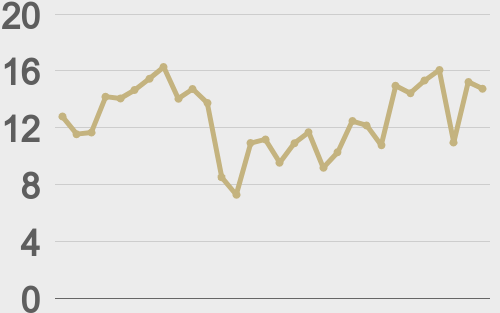

| BTCUSD avg. trade size last 30 days ($k) | ||||

| ||||

| ETHUSD avg. trade size last 30 days ($k) | ||||

| ||||

| Average daily range | ||||

| ||||

| ||||

@TheBlock__ | ||||

@TheBlock__ | ||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||