|

| 27 August 2025 Nvidia earnings loom large over risk, crypto takes cues |

| LMAX Digital performance |

|

LMAX Digital volumes were solid again on Tuesday. Total notional volume for Tuesday came in at $647 million, 12% above 30-day average volume. Bitcoin volume printed $345 million, 43% above 30-day average volume. Ether volume came in at $198 million, 6% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,751 and average position size for ether at $3,421. Bitcoin volatility has been edging higher but continues to consolidate off yearly low levels. Meanwhile, ETH volatility has surged to its highest level since December 2021. We’re looking at average daily ranges in bitcoin and ether of $3,175 and $271 respectively. |

| Latest industry news |

|

Bitcoin has faced mild selling pressure on Wednesday thus far, following a healthy recovery out from recent lows. Today’s move reflects a combination of long liquidations and a firmer U.S. Dollar, as Fed Chair Powell’s dovish tone Friday wasn’t as aggressive as markets had hoped. The dollar has benefited from hedge-fund-led demand and some position paring, with the perception that the next Fed easing cycle may be more cautious than previously thought. Ethereum has held up relatively well despite today’s mild downside pressure in bitcoin. Market focus remains on near-term catalysts, including a reported $15 billion in expiries for BTC and ETH options on Friday, where strong put demand suggests traders are favoring downside protection. Still, the medium-term narrative remains constructive. The Philippines has introduced a bill to launch a strategic bitcoin reserve, targeting 10,000 BTC accumulation over the next five years. This adds to the drumbeat of institutional adoption and sovereign-level interest, reinforcing a demand backdrop that continues unabated despite day-to-day volatility. Outside crypto, global markets are balancing several crosscurrents. U.S. stock futures are flat, with attention squarely on Nvidia ahead of its Wednesday earnings. As an AI bellwether, its results will have spillover effects across risk assets, especially as investors weigh concerns over a stretched tech bubble, China sales exposure, and shifting U.S. policy on chip exports. Adding to the geopolitical backdrop, Washington has imposed a 50% tariff on select Indian goods, escalating trade tensions in Asia. Looking ahead, crypto markets remain pinned between supportive structural flows and near-term macro caution. Treasury Secretary Bessent’s comments that the U.S. has no plans for a stake in Nvidia ease some tail risks, while Friday’s option expiries loom as the next major test. While short-term positioning looks fragile, sovereign and institutional interest, exemplified by the Philippines’ reserve proposal and ongoing ETF inflows, continue to provide a sturdy foundation for the asset class. |

| LMAX Digital metrics | ||||

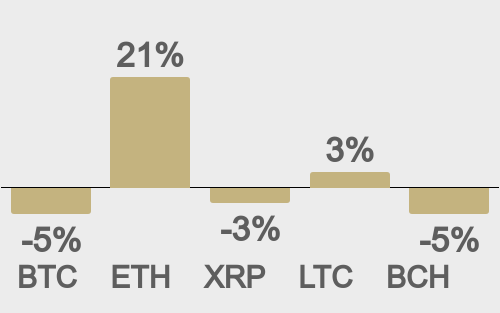

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

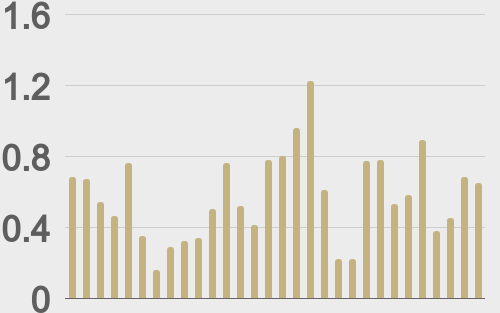

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

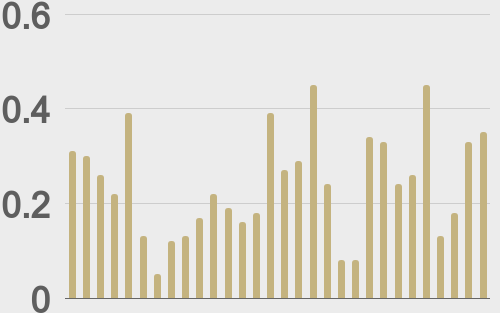

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||