|

|

2 September 2024 Perhaps a little more chop before the next big run |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $1.4 billion, 31% lower than a week earlier. Breaking it down per coin, bitcoin volume came in at $811 million, 45% lower than the previous week. Ether volume came in at $368 million, 8% higher than the week earlier. Total notional volume over the past 30 days comes in at $11.2 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,956 and average position size for ether at $2,652. Market volatility has cooled off dramatically after surging in early August. We’re looking at average daily ranges in bitcoin and ether of $2,403 and $127 respectively. |

| Latest industry news |

|

August was a tough month for crypto assets. Bitcoin closed the month down nearly 9%, while ETH was hit much harder, down 22%. On the one hand, the weakness didn’t come as much of a surprise given historical performance warning of a tough August. Looking back at bitcoin monthly performance from 2013 to 2023, August had been the worst performing month on a median return basis. Thus, the stage was already set for some ugly price action in the thinner summer month. Of course, the weakness in bitcoin filtered through to the rest of the crypto market as well. Yet, the interesting thing about the price action in August was that there really weren’t too many negative headlines to justify the bearish price action. Indeed, there were some outflows in the bitcoin and ETH ETFs. However, at the same time, we continued to see signs of more institutional adoption, more interest from traditional market participants, and a warmer political climate with the Harris campaign making its own efforts to embrace crypto friendly policy. Perhaps even more interesting is the fact that crypto assets traded lower in August despite a well offered US Dollar and a strong bid in US equities. If anything, the silver lining here is that it shows more evidence of crypto assets being uncorrelated with traditional assets, something that should be viewed as a net positive for traditional investors seeking portfolio diversification. It’s also worth highlighting that even with all the August weakness, bitcoin remains the standout outperformer year-to-date, up some 37% versus gold (+16%) and the S&P500 (+14%). Looking ahead, it’s possible we see more chop in September before an end of year surge in demand. September is bitcoin’s worst month on an average return basis since 2013. The good news here is that September 2023 was a positive month, perhaps marking an end to the bad streak. The other good news is that bitcoin shines bright when it comes to performance in the fourth quarter. Technically speaking, the outlook remains highly constructive for both bitcoin and ETH and the current weakness is viewed as nothing more than setbacks within a bullish consolidation. As per today’s technical insights, evidence of a stronger ETH relative to bitcoin is a welcome development as it often reflects a market with a healthier appetite for investment in the crypto space. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

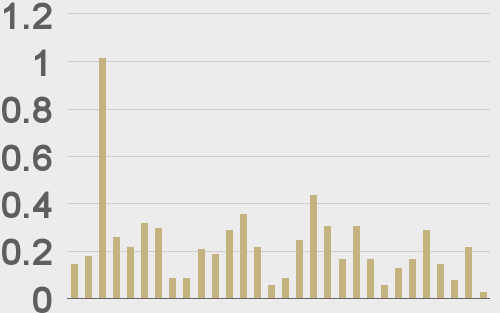

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@woonomic |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||