|

|

21 January 2025 Plenty of demand on dips |

| LMAX Digital performance |

|

LMAX Digital volumes got off to an impressive start this week, easily putting in the best daily performance on the year thus far. Total notional volume for Monday came in at $1.4 billion, 165% above 30-day average volume. Bitcoin volume printed $753 million on Monday, 209% above 30-day average volume. Ether volume came in at $181 million, 138% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,829 and average position size for ether at $2,354. Market volatility is trending back up towards the December peak. We’re looking at average daily ranges in bitcoin and ether of $4,340 and $204 respectively. |

| Latest industry news |

|

Monday’s bitcoin rally to a fresh record high ran into initial resistance ahead of $110,000. There was speculation of selling on the failure of President Trump to make any mention of crypto during the inauguration. However, such concerns appear to be vastly overstated, especially with so much commitment coming from President Trump towards the space in recent months, including the latest launch of his memecoins, activity at World Liberty Financial, and ongoing talk of a strategic bitcoin reserve. Whatever the case, the outlook remains exceptionally bright, with Monday setbacks well supported into the dip. Price action in traditional markets has helped to prop up crypto assets as well. We’ve been seeing a move back towards more rate cuts than less in 2025, albeit a mild move. Nevertheless, days back, Fed funds futures were pricing closer to just 1 rate cut in 2025. Today, that number has jumped to an expectation of 42 basis points of cuts in 2025. The net result is a yield differential moving out of the US Dollar’s favor, which in turn, has opened broad based gains in currencies against the US Dollar. This of course has extended to cryptocurrency gains against the Dollar on the yield differential shift. Over in the world of Ethereum, there have been efforts to get the Ethereum Foundation to take a more active role in supporting the blockchain. These efforts have been followed up with announcements from its co-founders acknowledging the need to move in this direction. This has also been accompanied by a move of 50,000 ETH into a wallet dedicated to supporting decentralized finance protocols on Ethereum. ETH has been a laggard in recent months and has yet to take out its record high from 2021 despite bitcoin making its own record highs on a consistent basis. Technically speaking, ETH has been showing signs of wanting to breakout to the topside and push through that record high. But the market will need to establish back above $4k to strengthen this prospect. |

| LMAX Digital metrics | ||||

|

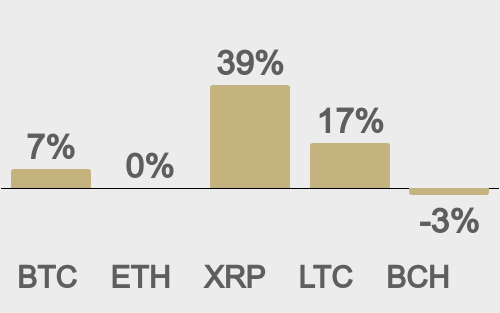

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||