|

|

29 February 2024 Price action goes parabolic |

| LMAX Digital performance |

|

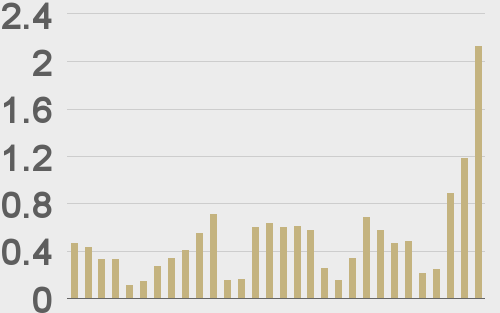

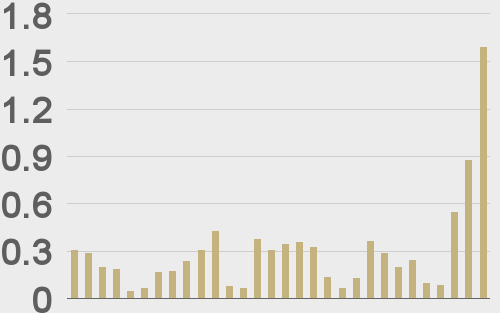

Wednesday LMAX Digital volumes printed the highest number since early January. Total notional volume for Wednesday came in at $2.1 billion, 321% above 30-day average volume. Bitcoin volume printed $1.6 billion on Wednesday, 435% above 30-day average volume. Ether volume came in at $381 million, 152% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $13,906 and average position size for ether at $3,865. Volatility continues to trend back towards January peak levels. We’re looking at average daily ranges in bitcoin and ether of $2,176 and $127 respectively. |

| Latest industry news |

|

Bitcoin is up nearly 50% year-to-date, while ether performance has been even more eye popping, exceeding 50% year-to-date. Bitcoin is trading at its highest level against the US Dollar since November 2021 and is within a stone’s throw of taking out the record high from the same month. Bitcoin has also easily pushed back up well above a $1 trillion market capitalization. Ether has rocketed to its highest level since April 2022. Volumes have naturally pushed back to the highest levels since the initial buzz around the ETF launches in early January. As far as market drivers go, it’s clear the warm reception to the spot bitcoin ETFs has been a major catalyst for price appreciation. ETF inflows continue to trend up and continue to post fresh record highs. And this isn’t without good reason. The bitcoin ETFs have opened the door for mainstream adoption in a seamless way, and into an extremely scarce asset. We also believe there is added demand coming from all of the anticipation into the bitcoin halving event (due in April), along with expectations that the approval of the bitcoin ETFs has opened up a clear path for ether spot ETF approvals in the US. Another important consideration here is US equities. On the one side, the fact that US equities are tracking at record highs and global sentiment is running where it is, certainly hasn’t hurt the crypto rally. But perhaps more importantly, we have also seen lower correlations between crypto and US equities of late, something that should embolden investors and further encourage investment in the nascent asset class as an attractive portfolio diversification strategy. It is however important to recognize that short-term technical studies are through the roof, which warns a correction and consolidation should be expected in the sessions ahead. But the overall outlook remains highly constructive and any setbacks should continue to be exceptionally well supported on dips. |

| LMAX Digital metrics | ||||

|

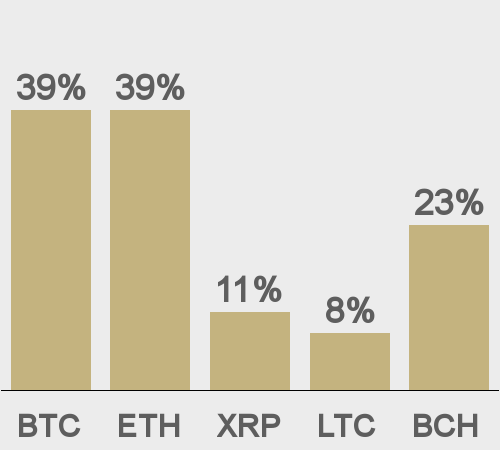

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

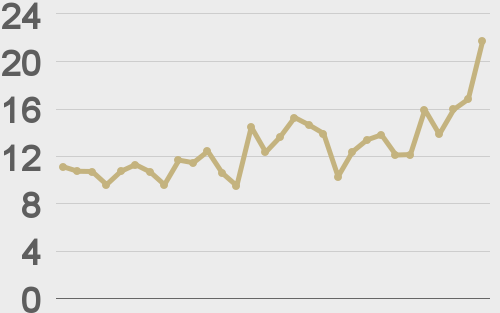

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

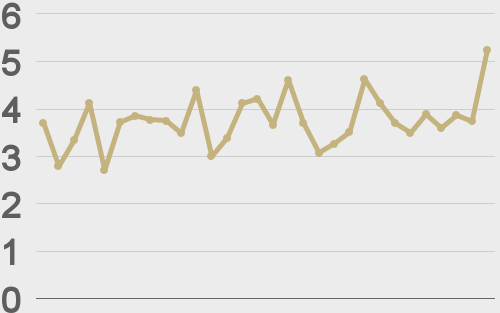

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||