|

|

24 August 2023 Price jump accompanied by impressive volume |

| LMAX Digital performance |

|

LMAX Digital volume has been trending up throughout the week, putting in a very solid performance on Wednesday. Total notional volume for Wednesday came in at $298 million, 54% above 30-day average volume. Bitcoin volume printed $173 million on Wednesday, 59% above 30-day average volume. Ether volume printed $92 million, 70% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,998 and average position size for ether at $3,025. Volatility has also been trending higher since bottoming out at cycle lows last week. We’re looking at average daily ranges in bitcoin and ether of $704 and $50 respectively. |

| Latest industry news |

|

On Wednesday, we talked about the technical case for a bounce in cryptocurrencies, citing oversold momentum indicators and critical support levels. And on Wednesday, this is how things played out, with bitcoin and ether putting in impressive recoveries. The primary fundamental catalyst for the move higher comes from traditional markets. Wednesday’s round of unimpressive PMI reads across the globe has resulted in a pullback in yields on the expectation this will be inspire less aggressive, more investor friendly monetary policy. And so, with stocks rallying and the US Dollar selling off, cryptocurrencies were able to benefit. The price action is enough to take the immediate pressure off the downside, though we will still need to see more recovery to get the market feeling bullish again. Interestingly enough, ether has been performing just a little better than bitcoin of late. We believe we’re seeing added demand for ether on the back of the success of Base, a new Layer-2 Ethereum solution. EigenLayer, an Ethereum re-staking protocol has also been getting a lot of positive attention. Total value locked has tripled in size to about $240 million. Looking ahead, we continue to wait for more clarity from the courts and the SEC. The market will also be focused on tomorrow’s highly anticipated Fed Chair Powell speech from Jackson Hole. |

| LMAX Digital metrics | ||||

|

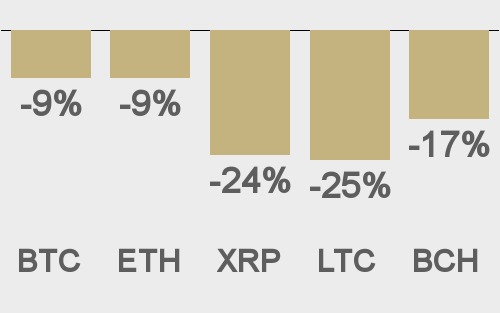

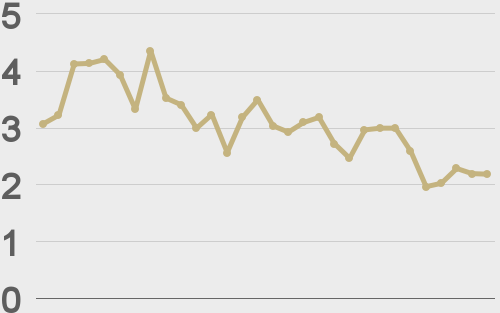

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

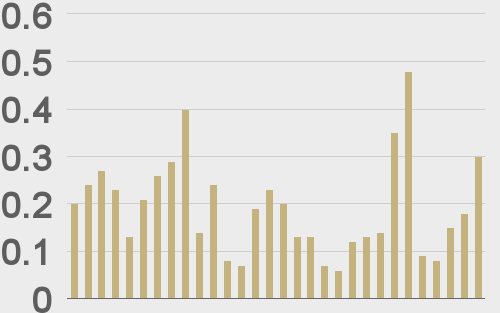

Total volumes last 30 days ($bn) |

||||

|

||||

|

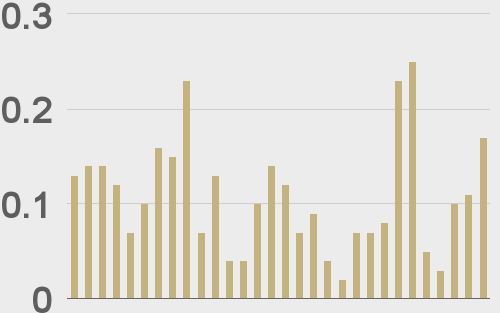

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

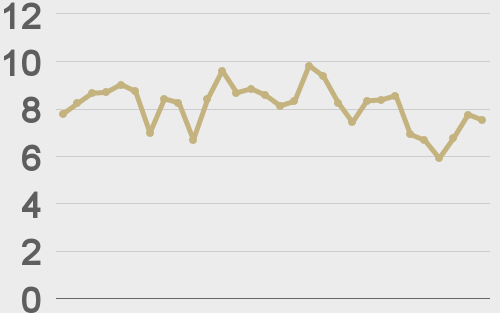

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||