|

|

9 May 2023 Prices lower but volume pushes up |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a good start this week. Total notional volume for Monday came in at $574 million, 29% above 30-day average volume. Bitcoin volume printed $326 million on Monday, 22% above 30-day average volume. Ether volume came in at $161 million, 29% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,675 and average position size for ether at 2,770. Volatility has been trending lower in correction mode after peaking out at a yearly high in March. We’re looking at average daily ranges in bitcoin and ether of $1,029 and $78 respectively. |

| Latest industry news |

|

Crypto markets are under pressure as the new week gets going. There were some short-term developments that could have been impacting price action on Monday, though ultimately, we believe any meaningful weakness we see is coming from global macro factors. On Monday, there were reports of a large bitcoin outflow and withdrawals being paused at a major exchange, which perhaps factored into some of the selling we had been seeing. But there were also bigger picture things going on that probably played a bigger role. Those bigger picture things revolve around market pricing of Fed monetary policy looking out for the remainder of the year. The market has priced a Fed pause on rate cuts and three rate cuts in the second half of the year. This pricing has driven yield differentials out of the US Dollar’s favor, which had been supporting crypto assets in recent weeks. But if we take a closer look at this past Friday’s US jobs report, there is evidence that would suggest the US Dollar should be heading higher, not lower. It feels like the market woke up to this on Monday, giving more serious consideration to a strong jobs report and accompanying higher hourly earnings, that would suggest the Fed should still be needing to worry about higher inflation and pushing rates higher to offset inflation. If this proves to be the case, we suspect we will see a more significant recovery in the US Dollar, with yield differentials moving back in the Buck’s favor, which could then have a weighing impact on crypto prices over the coming sessions. Technically speaking, we’ve highlighted the possibility of a Head & Shoulders top on the bitcoin daily chart. If bitcoin support is taken out at $26,525, it would trigger the formation and open a measured move downside extension target of $22,000. Ultimately however, if we do see bitcoin drop back down to $22,000, we believe any additional setbacks will be limited, with the greater risk for a major higher low and move back to the topside through the yearly high and eventually back towards a retest of the record high. |

| LMAX Digital metrics | ||||

|

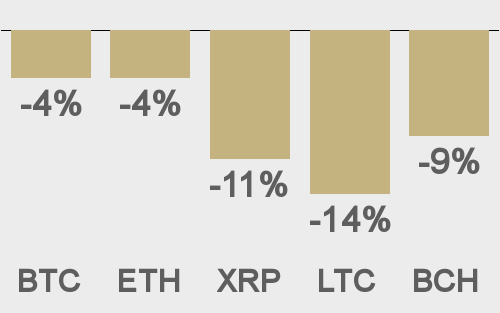

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

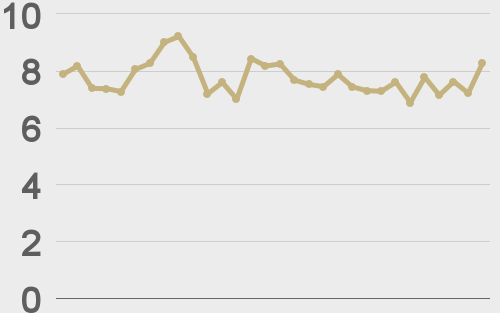

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||