|

| 22 July 2025 Pullback not to be confused with breakdown |

| LMAX Digital performance |

|

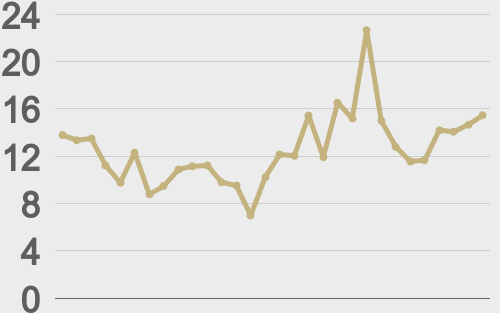

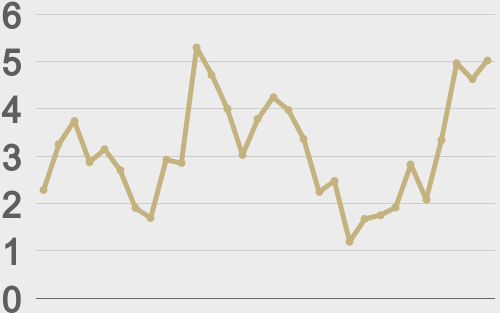

LMAX Digital volumes got off to a solid start this week. Total notional volume for Monday came in at $657 million, 23% above 30-day average volume. Bitcoin volume printed $244 million, 2% below 30-day average volume. Ether volume came in at $165 million, 23% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,774 and average position size for ether at $2,747. Bitcoin volatility is tracking just off yearly low levels. ETH volatility has ticked up in recent days, but is still mostly sideways since bottoming out in May. We’re looking at average daily ranges in bitcoin and ether of $2,881 and $158 respectively. |

| Latest industry news |

|

The crypto market has calmed down over the past 24 hours, with bitcoin consolidating below recent highs and ETH running into a round of modest profit taking after a parabolic move. According to one on-chain analytics firm, wallets of all sizes — including 10K+ BTC “whales” — are back in accumulation mode at levels not seen since December 2024. This broad-based behavior points to durable conviction behind the current bitcoin rally, even as price action softens. The data suggests on-chain fundamentals remain firmly bullish, adding support to the longer-term constructive outlook. ETH continues to draw attention, outperforming BTC over multiple sessions and contributing to a rising chorus of voices declaring the onset of altcoin season. From a structural view, the bitcoin pullback could reflect a psychological shift, with capital rotating into altcoins while still anchored by strong institutional flows into crypto more broadly. Macro conditions remain benign, offering little resistance to crypto upside. Global equities were flat to modestly higher, U.S. yields have softened on dovish Fed expectations, and geopolitical headlines have taken a backseat for now. There’s no material macro headwinds disrupting flows into digital assets, which continues to favor risk-taking in the space — albeit with more dispersion under the surface. As per our technical insights, we view the current period of pullback as an overdue correction and consolidation rather than any breakdown. The ETH-led rotation and whale accumulation support the case for a sustained bull cycle, even if we see a period of correction in the sessions ahead. |

| LMAX Digital metrics | ||||

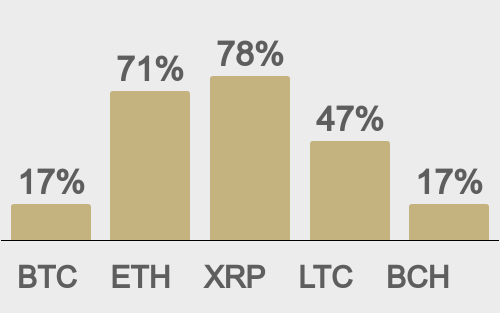

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

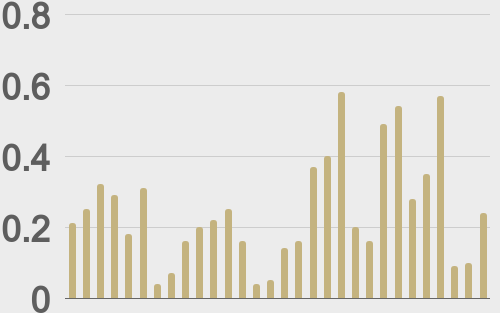

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||