|

|

16 August 2023 Putting things in perspective |

| LMAX Digital performance |

|

LMAX Digital volumes improved on Tuesday from a day earlier, but were still well off 30-day average volumes. Total notional volume for Tuesday came in at $133 million, 35% below 30-day average volume. Bitcoin volume printed $74 million on Tuesday, 36% below 30-day average volume. Ether volume came in at $31 million, 42% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,560 and average position size for ether at $3,302. Volatility continues to track near multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $534 and $32 respectively. |

| Latest industry news |

|

It should come as no surprise to see the lower volumes in crypto assets given the extremely low volatility right now. At the same time, this shouldn’t be taken as a negative. Overall, price action has been quite constructive since bitcoin and ether bottomed in 2022. And year to date, bitcoin and ether have done a good job outperforming other major asset classes. Bitcoin is up over 75% year to date, while ether is up around 55%. And so, it really just comes down to the market caught in a holding pattern and waiting for the next catalyst to get things going. Throw in already thinner summer trading conditions and all of it is even easier to digest. Clearly, there is plenty of anticipation around developments out of the US with respect to regulation and court rulings. Still, it could be many more weeks, if not months, before we get any clarity on this front. But as we wait, crypto sentiment has leaned more upbeat, and there is a higher degree of confidence things will continue to progress in a favorable direction for the industry. Moreover, crypto assets have proven to be quite resilient in the face of a deterioration in global sentiment and downside pressure on equities. Most recently, friendly pressures have emerged out of Europe, with London-based Jacobi Asset Management rolling out Europe’s first Bitcoin ETF. We suspect this move will help usher in a smoother path towards institutional adoption, with these players gaining more secure, transparent, sustainable, and reliable access to the market. |

| LMAX Digital metrics | ||||

|

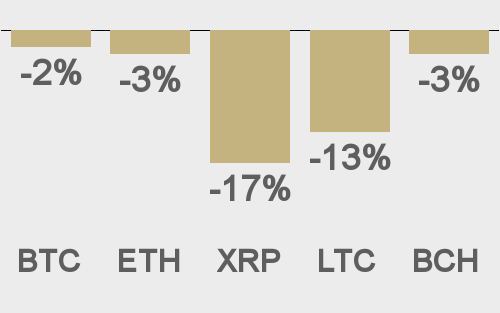

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

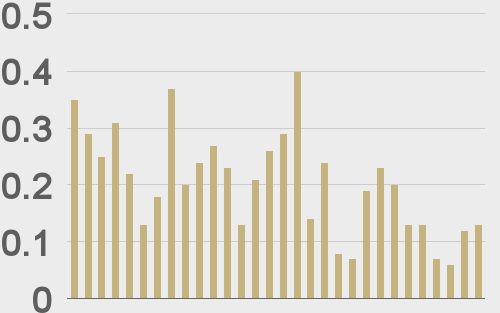

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

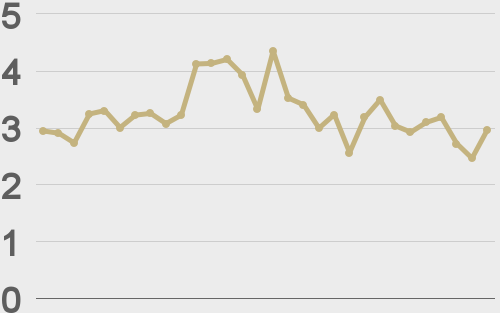

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||