|

|

12 March 2025 Relative strength |

| LMAX Digital performance |

|

LMAX Digital volumes put in a healthy performance on Tuesday. Total notional volume for Tuesday came in at $710 million, 41% above 30-day average volume. Bitcoin volume printed $301 million on Tuesday, 27% above 30-day average volume. Ether volume came in at $190 million, 84% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,775 and average position size for ether at $1,622. Bitcoin volatility is tracking at peak levels, while ETH volatility has been more contained. We’re looking at average daily ranges in bitcoin and ether of $4,997 and $200 respectively. |

| Latest industry news |

|

The market will be hoping Tuesday’s bitcoin bounce is the start to a resumption of the bigger picture uptrend. Technically speaking, while we believe we are a lot closer to seeing that bottom, there is still room for the correction to extend back to retest previous resistance now turned support in the $69k-74k area. The most positive news over the past 24 hours is the relative strength in bitcoin and other crypto assets relative to US equities. On Tuesday, US equities extended their 2025 decline and weren’t able to recover all that much off the lows. Meanwhile, bitcoin and ETH put in bullish closes, ending a sequence of consecutive daily down days. The other development we’re keeping an eye on is ETH performance relative to bitcoin. Indeed, ETH is still trending lower against bitcoin. But there have also been signs of ETH perhaps wanting to reconsider this trend. Such a trend reversal where ETHBTC is trading back to the topside is a healthy signal for the crypto space, as it suggests appetite for crypto assets is picking up to the point where investors are excited in investing beyond bitcoin. Fundamentally speaking, things continue to look bright with respect to the crypto outlook as the US embraces the asset class and as mainstream adoption ramps up. At the moment, the biggest hangup comes from all of the uncertainty in traditional markets. But again, as highlighted with respect to Tuesday price action, crypto assets need not correlate with traditional risk assets. It’s important for investors to see days like Tuesday so they can be more convinced of crypto being an attractive investment for portfolio diversification. |

| LMAX Digital metrics | ||||

|

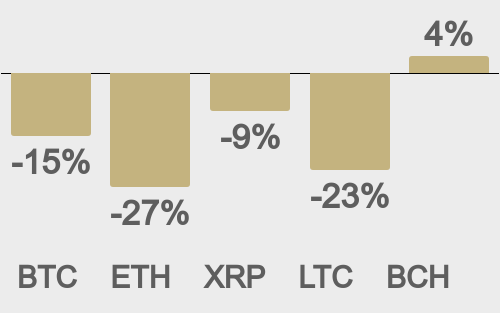

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

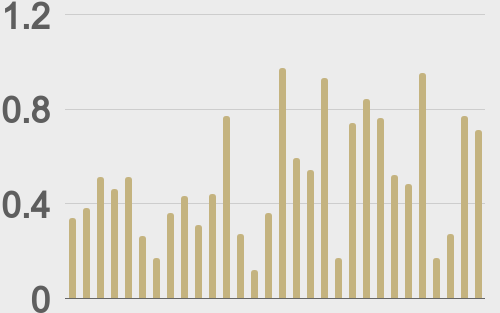

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

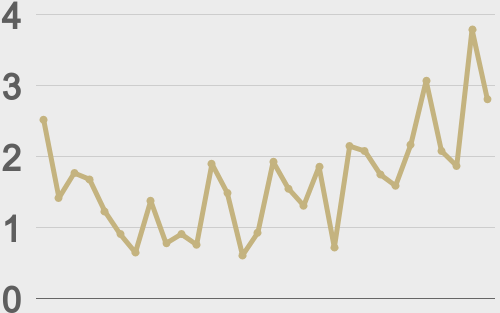

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||