|

|

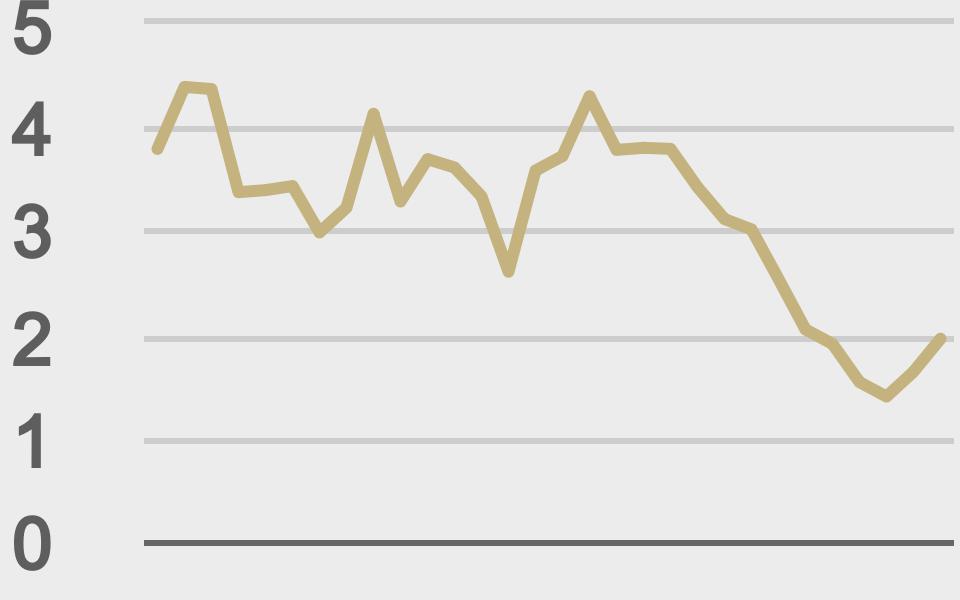

| Risk for one more healthy decline |

| LMAX Digital performance |

|

Volumes at LMAX Digital have been showing signs of ticking back up in the aftermath of anemic activity. The dip in volume that we’ve seen is an offshoot of exhaustion after record volumes from earlier this year through May, thinner summer trade, and some very tight consolidation in bitcoin and ether. But over the past week or so, volumes have been ticking back up and pulling back towards 30-day average volume levels. On Monday, total notional volume was just 10% off 30-day average volume. Bitcoin volume was also off about 10% from 30-day average volume, and Ether was more impressive, down just 5% from 30-day average volume. Total notional volume over the past 30 days at LMAX Digital comes in at $26.1 billion. |

| Latest industry news |

|

Headlines haven’t been all that upbeat over the past 24 hours and we continue to hear about more crackdowns and increased regulatory scrutiny. All of this comes at a time when crypto assets are already feeling the heat from a massive bout of risk liquidation flow in traditional financial markets. Technically speaking, bitcoin has fallen into major support, back below $30,000 and contemplating a breakdown below the critical June low at $28,800. If the market takes out this level and establishes a daily close below, it will likely open the door for the next major downside extension towards previous resistance turned support at $20,000. But overall, the outlook remains exceptionally bright. The possibility of a pullback to the previous record high from late 2017 in the $20,000 area was something we had considered a long while back and we suspect once we get down to this level, there will be plenty of demand from institutional accounts desperate to gain or increase exposure to the asset class. On a positive note, Fidelity has been bulking up their crypto operations and put out a survey a few weeks back that showed that looking out 5 years, more than 90% of surveyed investors would want to have some exposure to crypto assets in their portfolios. And over in NFT land, OpenSea has just been valued at $1.5 billion after funding a round led by a16z. |

|

LMAX Digital metrics |

||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

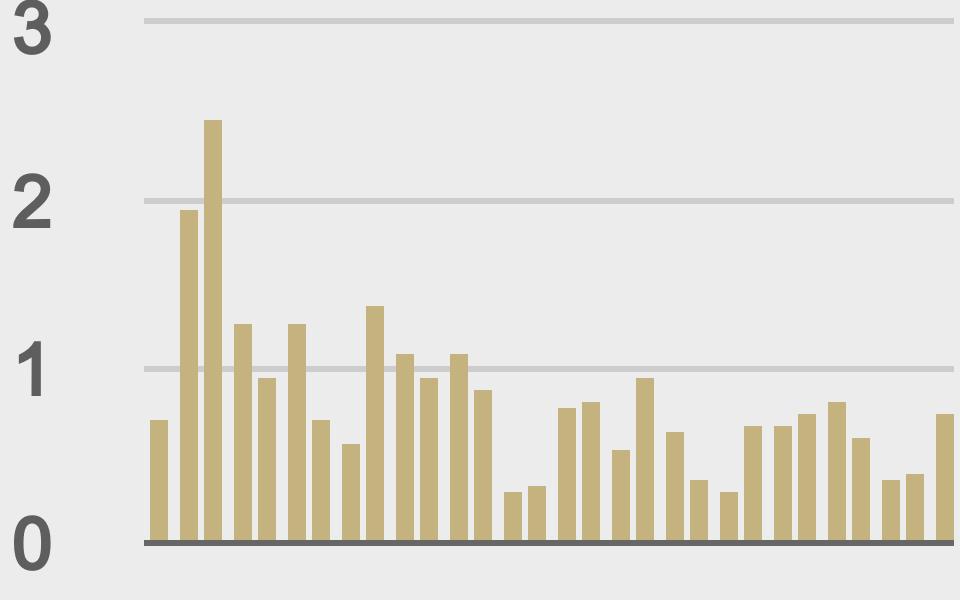

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

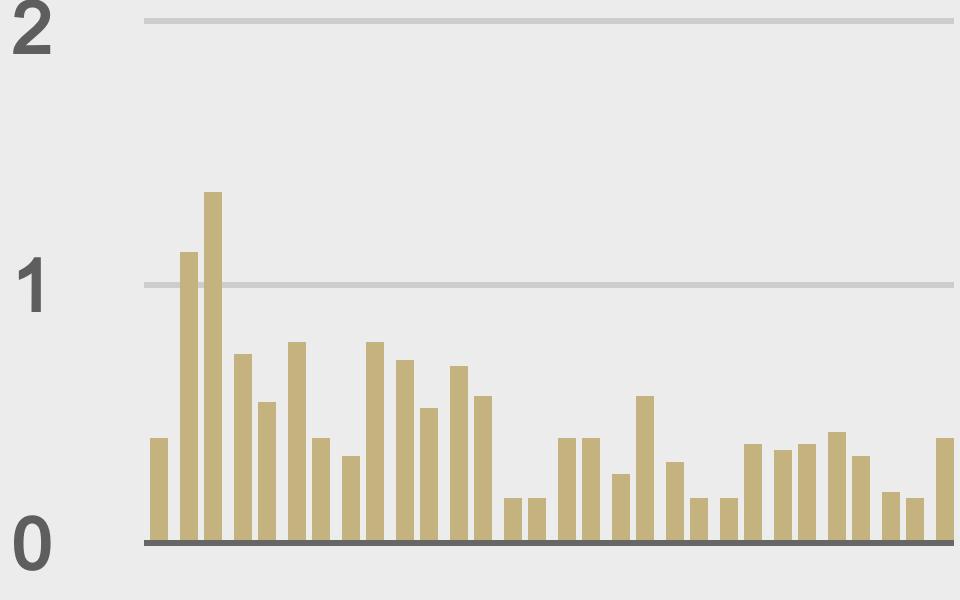

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

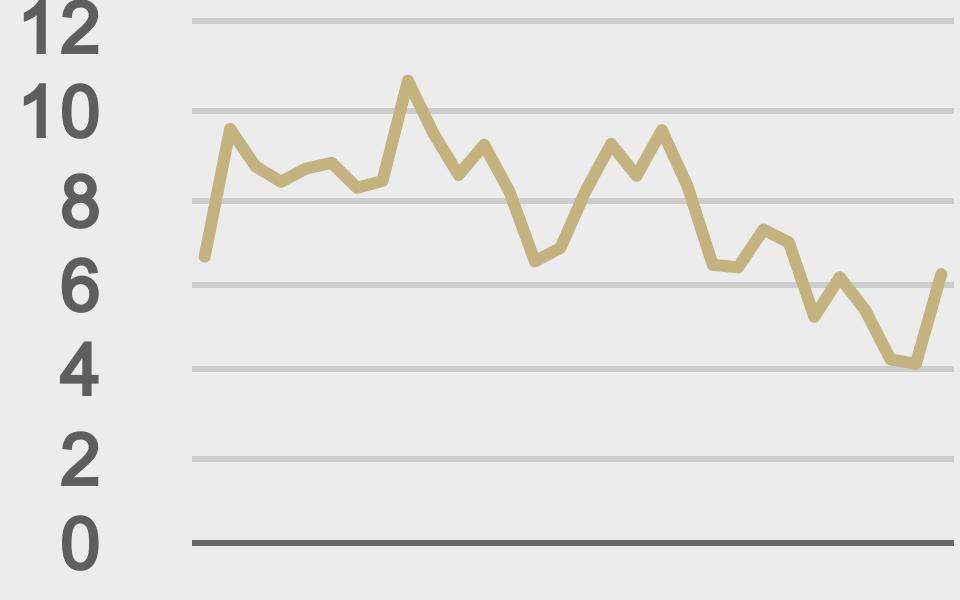

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@zackseward |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||