|

|

| Risk from the outside |

| LMAX Digital performance |

|

Despite the lower volumes in July, mostly on the back of the thinner summer trading conditions, we have seen a progressive pickup in volumes throughout the week. Total notional volume at LMAX Digital came in at $782 million on Wednesday, up over 10% from Monday and Tuesday volumes. Total notional volume at LMAX Digital over the past 30 days comes in at $28.4 billion. Average trading size for Bitcoin over the past 30 days comes in at $8,386. Average trading size for Ether over the past 30 days comes in at 3,527. The average daily trading range for BTCUSD is $2,033. The average daily trading range for ETHUSD is $176. |

| Latest industry news |

|

The biggest risk to crypto assets at the moment is the risk of a capitulation in US equities. As we head into the end of the week, attempts to prop up global sentiment have fallen by the wayside. First it was China’s RRR cut, then it was Fed Chair Powell’s attempts to reassure investors that the central bank is committed to its dovish track. Unfortunately, the big problem is all of the harsher realities out there that are making it difficult to continue to buy into accommodative central bank gestures. After all, central bank policy is exhausted, coronavirus is still a threat, the second half global growth outlook is questionable, and inflation is running hot. While we recognize Bitcoin’s longer term value proposition as an asset that should be a wonderful flight to safety, inflation hedge play, at the moment, Bitcoin still has some emerging market properties given the youth of the asset. This exposes it somewhat to periods of risk off in global markets. And by extension, if Bitcoin is at risk from a meltdown in stocks, Ether should be equally, if not more vulnerable in such a period. Ether is a blockchain facilitating new innovation and is very much seen as a form of stock market 2.0. Technically speaking, nothing has really changed at this point. Both Bitcoin and Ether are consolidating within tight ranges and holding above recent bases. It would take a break back below the June lows in the prices of Bitcoin and Ether ($18,800 and $1,700 respectively) to suggest we are in fact at risk of another decline. |

|

LMAX Digital metrics |

||||

|

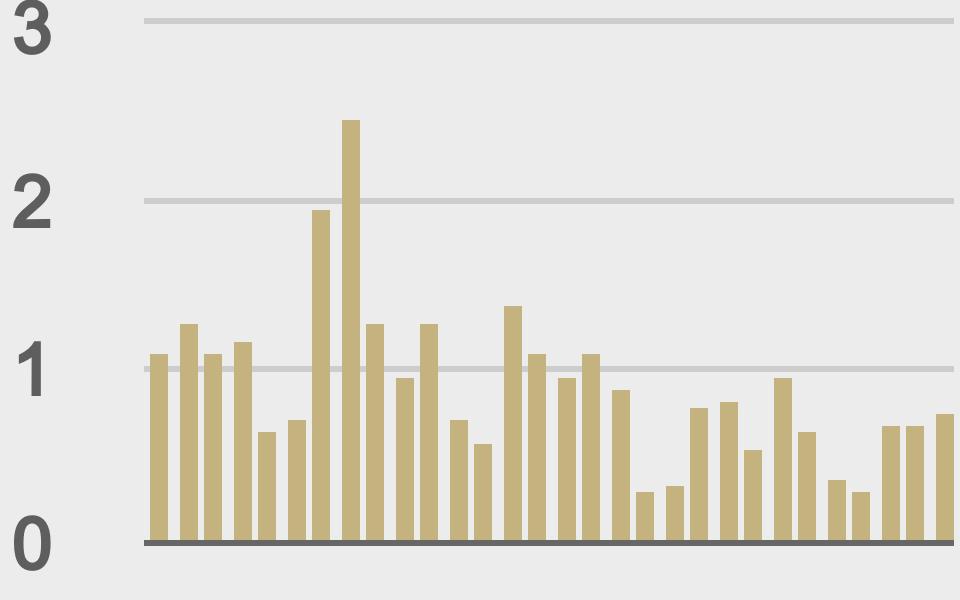

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

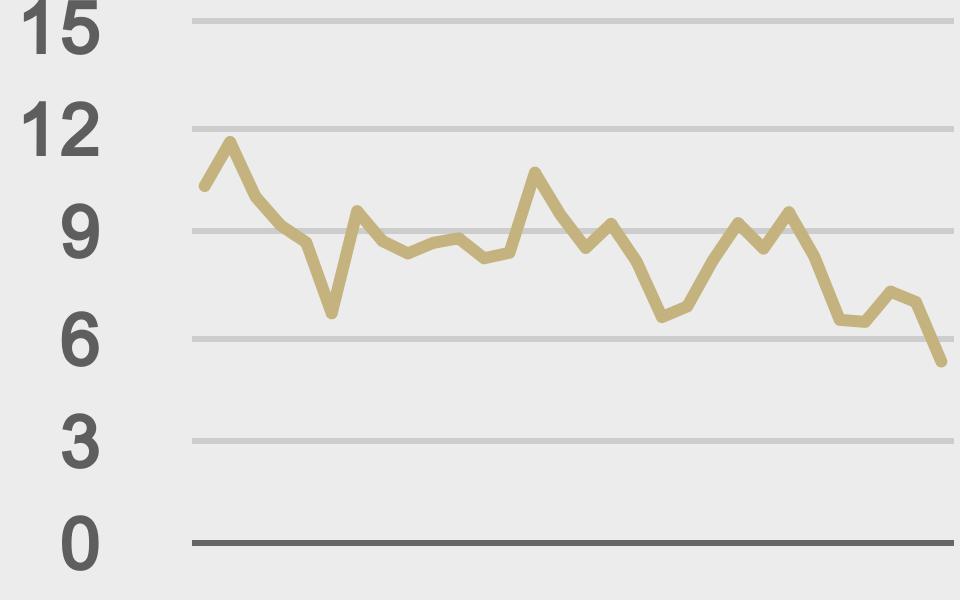

Total volumes last 30 days ($bn) |

||||

|

||||

|

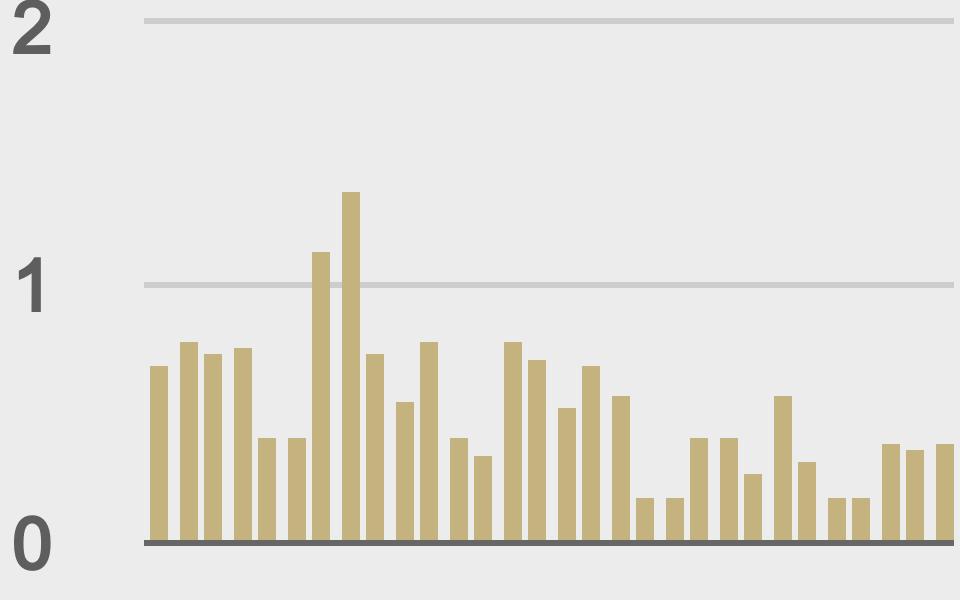

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

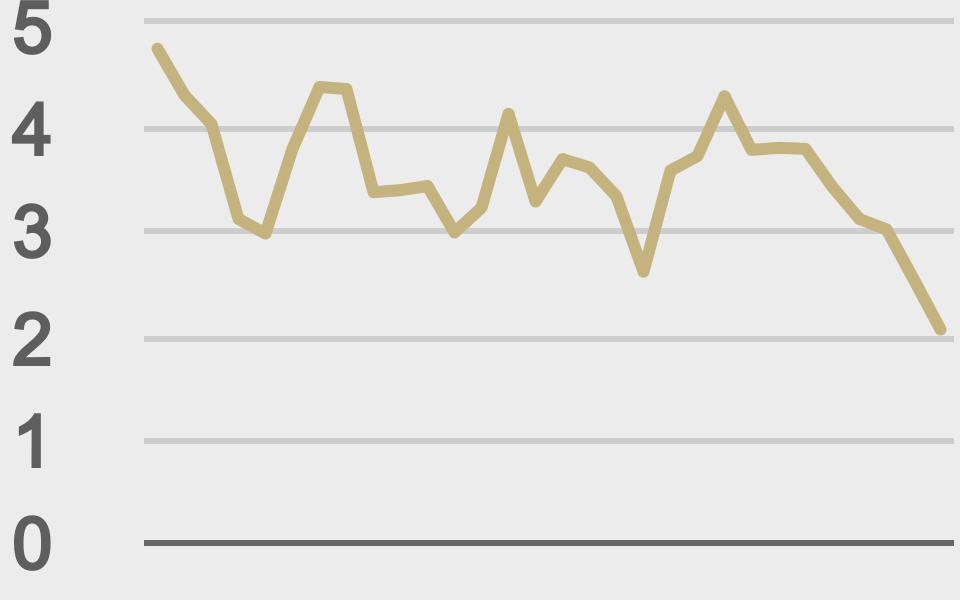

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@KaikoData |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||