|

|

14 September 2023 Risk that was already priced in |

| LMAX Digital performance |

|

LMAX Digital volume has been impressive all week. Total notional volume for Wednesday cooled off from Tuesday’s robust levels, but still managed to come in at $220 million, 12% above 30-day average volume. Bitcoin volume printed $145 million on Wednesday, 19% above 30-day average volume. Ether volume printed $54 million, 3% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,488 and average position size for ether at $2,379. Volatility has steadied after picking up from cycle lows in August. We’re looking at average daily ranges in bitcoin and ether of $714 and $46 respectively. |

| Latest industry news |

|

As expected, the Delaware Bankruptcy court approved FTX’s proposal to liquidate its crypto assets. And also as expected, there has been little to no fallout in the aftermath, with the event already mostly priced in and digested earlier in the week. As a refresher, the amount of bitcoin and ether that will be sold won’t be enough to cause any major market disruptions. Furthermore, the selling will happen gradually over time, which will make it that much easier for the market to absorb. Moving on, Wednesday’s US CPI data proved to be a non-event, with readings producing mixed results. We have seen yield differentials move mildly out of the US Dollar’s favor since the data, which could be supporting crypto assets. Technically speaking, it’s all about keeping an eye on the price of bitcoin. The price has been well supported on dips into the $25k area, but will need to push back above the high from August 29 at $28,200 to inspire a fresh round of bullish momentum. We ‘re already just about half way through the month of September and the market is very much looking forward to getting out of what has been the worst performing month for crypto over the past seven years. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

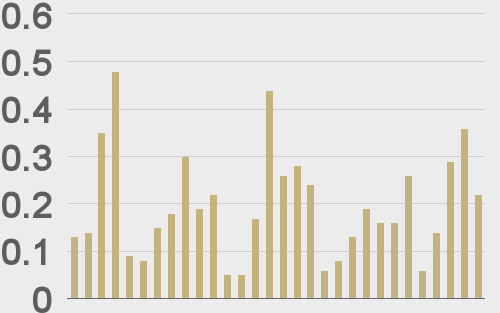

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||