|

|

21 February 2024 Running into resistance…at least for a moment |

| LMAX Digital performance |

|

LMAX Digital volumes were impressive on Tuesday as the market returned to fuller form post the US holiday break. Total notional volume for Tuesday came in at $686 million, 69% above 30-day average volume. Bitcoin volume printed $369 million on Tuesday, 54% above 30-day average volume. Ether volume came in at $241 million, 110% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,798 and average position size for ether at $3,473. Volatility is slowly picking back up after sinking from January’s peak and bottoming out earlier in the month. We’re looking at average daily ranges in bitcoin and ether of $1,514 and $101 respectively. |

| Latest industry news |

|

There’s been plenty of buzz around the options market where traders are expressing their bullish sentiment, pricing bitcoin $75k in the coming months and $64k over the coming weeks. The reception of the new bitcoin ETF products has been exceptionally strong, while traders are also pricing in upside on account of the halving event, scheduled for April. Recent research also points to bullish metrics that show bitcoin whales moving holdings away from centralized exchanges, a sign they are less inclined to sell, which also means less bitcoin out there for people to buy. Ether has continued to benefit from all of the positive momentum. On Tuesday, the price of eth punched through the $3k barrier and traded to its highest level against the Buck since May 2022. Expectation for the approval of eth spot ETFs later this year, optimism around the upcoming Ethereum upgrade, and upbeat global sentiment have all helped to drive this latest push in the price of ether. There are however some things that make us a little more cautious over the coming days. Technically speaking, crypto markets could be looking a little extended, particularly ether, which has been tracking in overbought territory. We’ve also been concerned about the prospect for a major pullback in US equities, which could, at least for a short while, weigh on the price of crypto assets. Later today, we get the release of the always anticipated Fed Minutes. If the tone of the Minutes leans more to the hawkish side, it could open the door for a wave of risk liquidation, which could spill over into crypto assets. If on the other hand the Minutes come in more dovish, or even as expected, we expect there will be a wave of risk on flow and US Dollar outflows, which should help to prop crypto assets. |

| LMAX Digital metrics | ||||

|

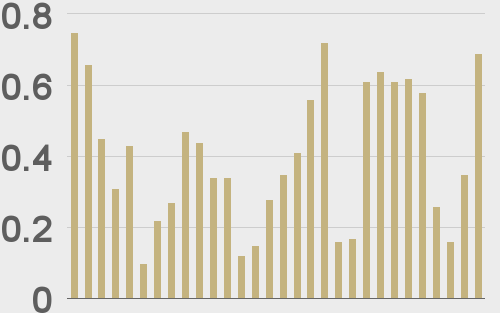

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

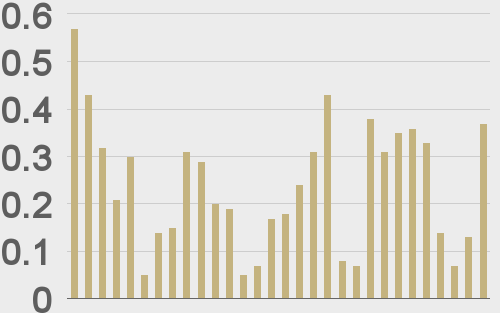

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

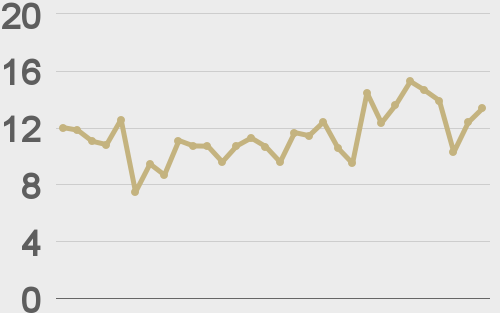

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@woonomic |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||