|

|

4 June 2024 Seasonality trends and June performance |

| LMAX Digital performance |

|

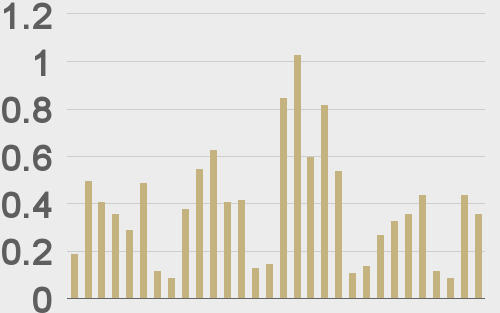

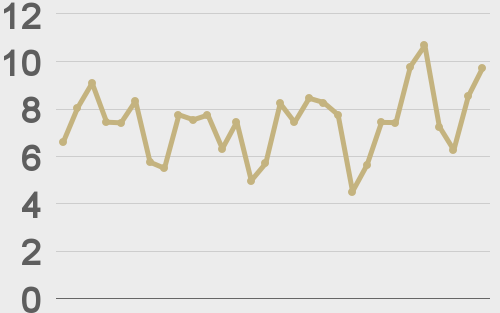

LMAX Digital volumes were a little on the lighter side on Monday. Total notional volume for Monday came in at $359 million, 8% below 30-day average volume. Bitcoin volume printed $212 million on Monday, 10% above 30-day average volume. Ether volume came in at $86 million, 36% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,726 and average position size for ether at $3,641. Market volatility for bitcoin continues to trend lower since peaking in March. Ether volatility has been trying to bottom out in recent weeks. We’re looking at average daily ranges in bitcoin and ether of $2,180 and $146 respectively. |

| Latest industry news |

|

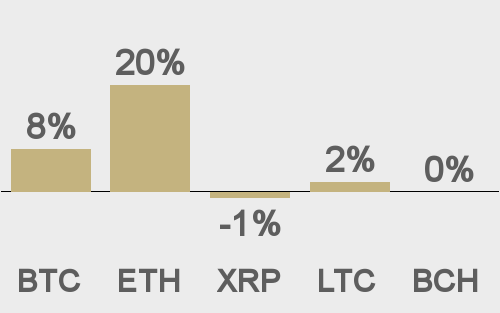

A run of softer economic data out of the US has forced yield differentials to shift out of the US Dollar’s favor, which has been good for currencies and risk assets overall. This has helped to keep crypto assets supported in recent sessions despite what has mostly been a lackluster, directionless performance. Technically speaking, the medium and longer-term outlook for crypto assets remains highly constructive, with fresh highs anticipated in both bitcoin and eth over the coming weeks and months. We’ve already seen bitcoin push to a record high in 2024 and expect this trend to carry over into the price of eth as well. If this holds up, it bodes well for the outlook, with eth still over 20% off the record high from 2021. As far as seasonality trends go, there isn’t much to be taken away from June performance since 2016. June has netted average gains for bitcoin of just 1.34% over this timeframe, though a lot of this data has been skewed by a horrid performance in 2022 (bitcoin -41%) when US inflation skyrocketed. On a positive note, US spot bitcoin ETFs have extended their positive streak of inflows to 15 days, and a nice amount of eth has been removed from centralized exchanges since the spot ETH ETF approval, which suggests the potential for an upcoming supply squeeze. |

| LMAX Digital metrics | ||||

|

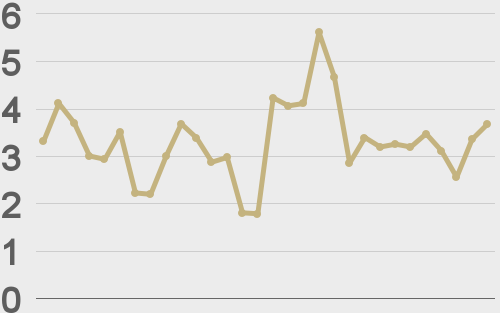

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@woonomic |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||