|

|

24 February 2025 Setbacks limited all things considered |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $2.3 billion, 5% higher than the week earlier. Breaking it down per coin, bitcoin volume came in at $1 billion, 14% higher than the previous week. Ether volume came in at $435 million, 7% higher than the week earlier. Total notional volume over the past 30 days comes in at $14.8 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,400 and average position size for ether at $1,777. Market volatility has cooled off considerably since peaking out in early February. We’re looking at average daily ranges in bitcoin and ether of $2,954 and $167 respectively. |

| Latest industry news |

|

Crypto assets are under a little pressure as the new week gets going. At the same time, there has been no material shift in an overall constructive outlook, with bitcoin confined to a bullish consolidation and ETH holding within a familiar range. As far as the setbacks go, one could easily argue that if anything, the setbacks have been well contained considering the negative headlines. The primary drivers of the recent weakness come from both news within the crypto space and from the outside. As far as the crypto specific source of weakness goes, the market has been shaken by the news of the $1.5 billion Bybit hack. However, confidence has been somewhat restored on reassurances of sufficient reserves. The other driver of negative sentiment is coming from the traditional markets. Friday’s collapse in US equities resulted in the worst day of performance in 2025. Correlations between crypto and stocks aren’t always perfect, though whenever we see extreme moves one way or the other, these correlations tend to be more relevant. A softer round of economic data out of the US was behind the downturn in investor risk appetite. At the same time, we suspect the market will look to respond to the silver lining here, which is economic data that forces the Fed into a more accommodative, investor friendly policy track. Technically speaking, bitcoin back above $100k and ETH above $2,900 will do a good job in helping to fuel the next wave of upside momentum. |

| LMAX Digital metrics | ||||

|

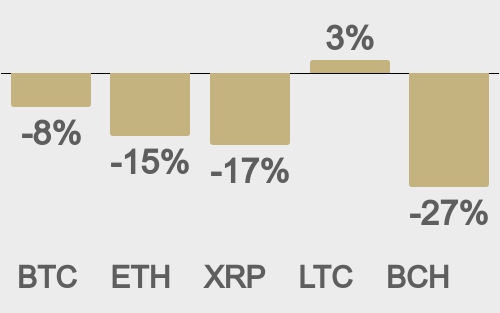

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

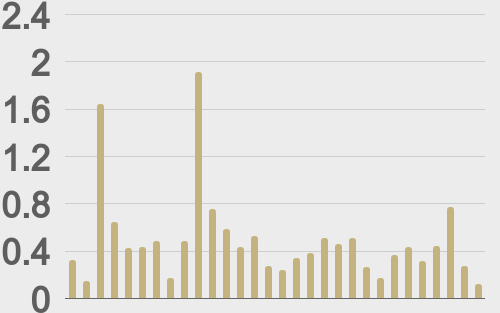

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

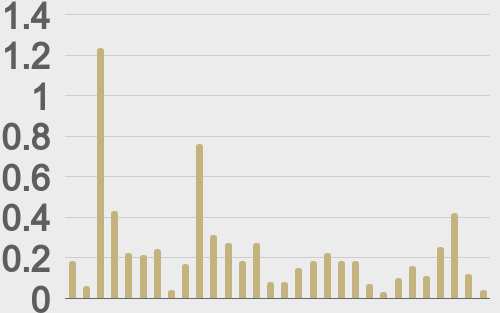

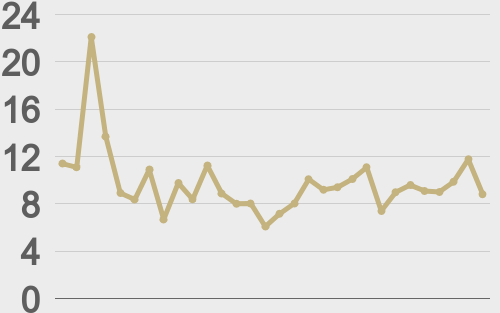

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

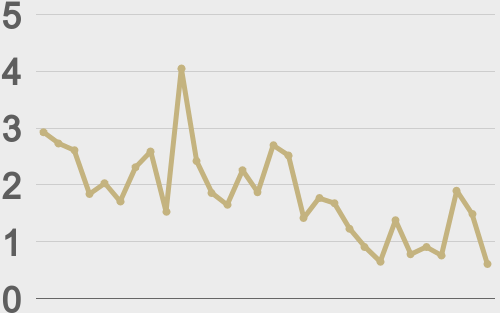

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||