|

|

23 February 2022 Short-Term vs Long-Term |

| LMAX Digital performance |

|

LMAX Digital volume leveled out on Tuesday after a strong start to the week. Total notional volume for Tuesday came in at $824 million, on par with 30-day average volume. Bitcoin volume printed $490 million on Tuesday, 12% above 30-day average volume. Ether volume came in at $266 million, 13% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,079 and average position size for ether at 6,642. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $1,965 and $188 respectively. |

| Latest industry news |

|

Most of the price action in crypto of late has revolved around all things geopolitical. The Russia-Ukraine tension has weighed on all things risk correlated, and for the time being, that includes crypto assets. We’ve also said we anticipate crypto to maintain this correlation with risk sentiment over the coming weeks, before it eventually breaks away. Simply put, there are some players who see the asset class as an emerging market, with sensitivity to risk sentiment, and that’s why we’ve been seeing what we’ve been seeing with crypto off as risk comes off. But medium and longer-term players recognize the true value proposition – that of an asset class with compelling technology and deflationary economics. As far as levels go, we think it would make sense to consider the possibility for another healthy drop in bitcoin towards $25,000 and ether towards $1,800, at which point, we see these markets well supported and in position to finally turn back up, eventually to fresh record highs. Fundamentally, there have been some crypto specific positives. The EU seems to be considering the adoption of cryptocurrencies over the next few years, Ukraine has legalized crypto, and Russia is in the process of drafting legislation to accept crypto as legal tender. |

| LMAX Digital metrics | ||||

|

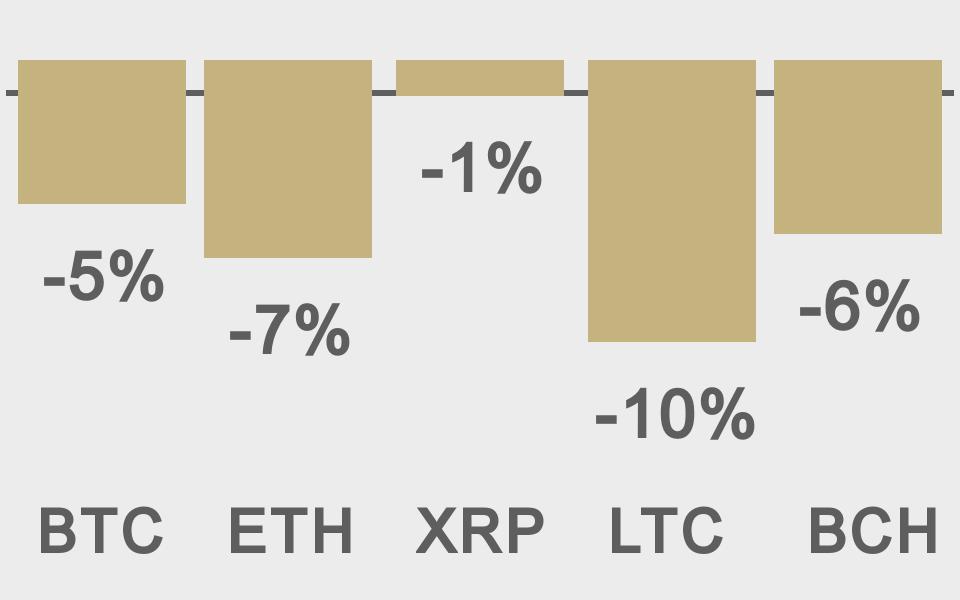

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

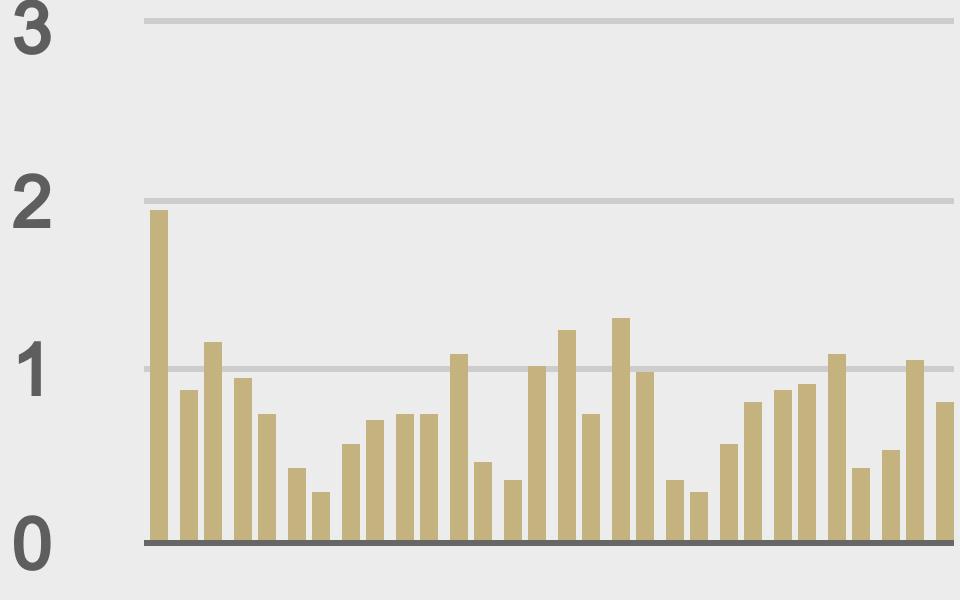

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

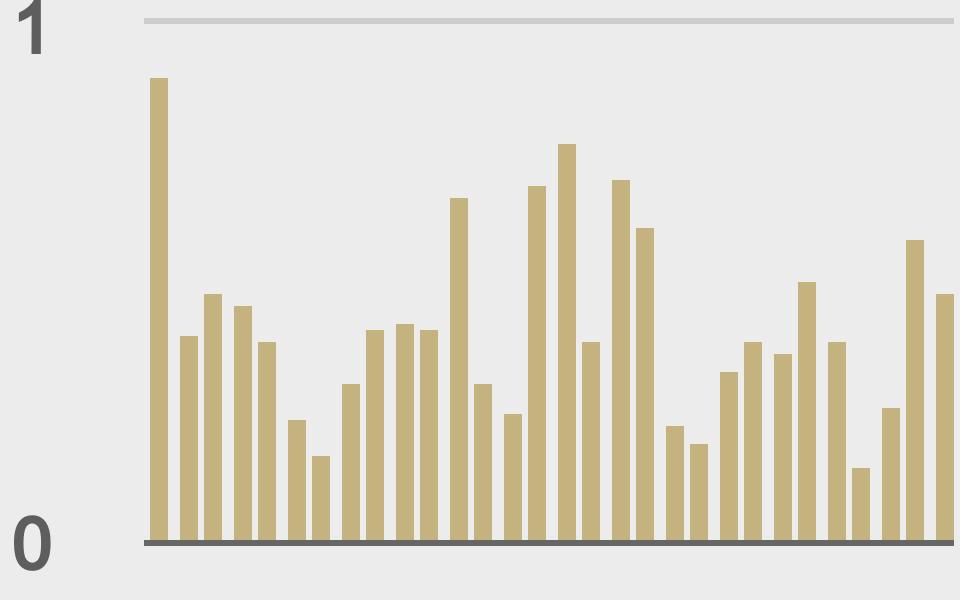

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||