|

|

18 November 2021 Signs of deeper setbacks |

| LMAX Digital performance |

|

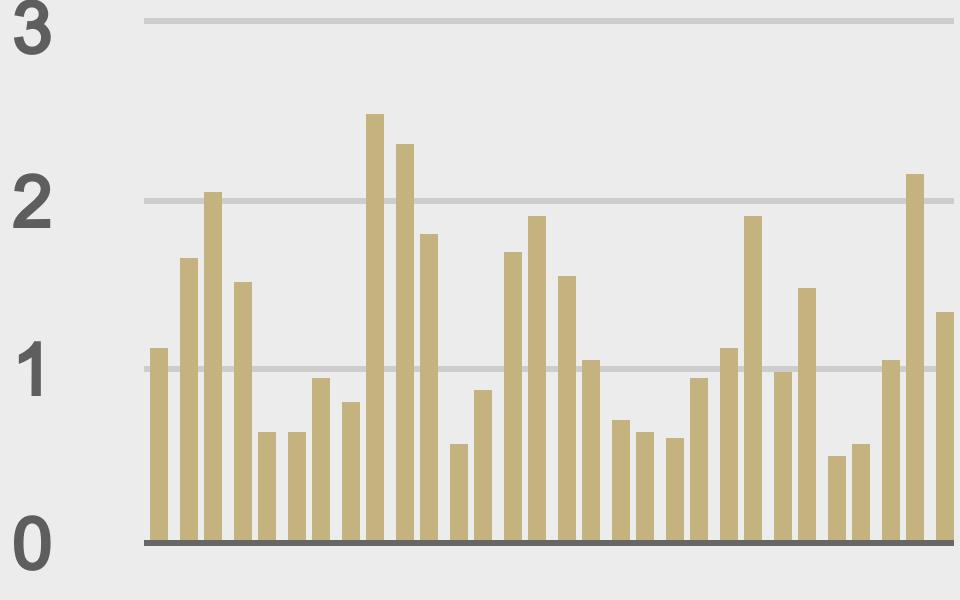

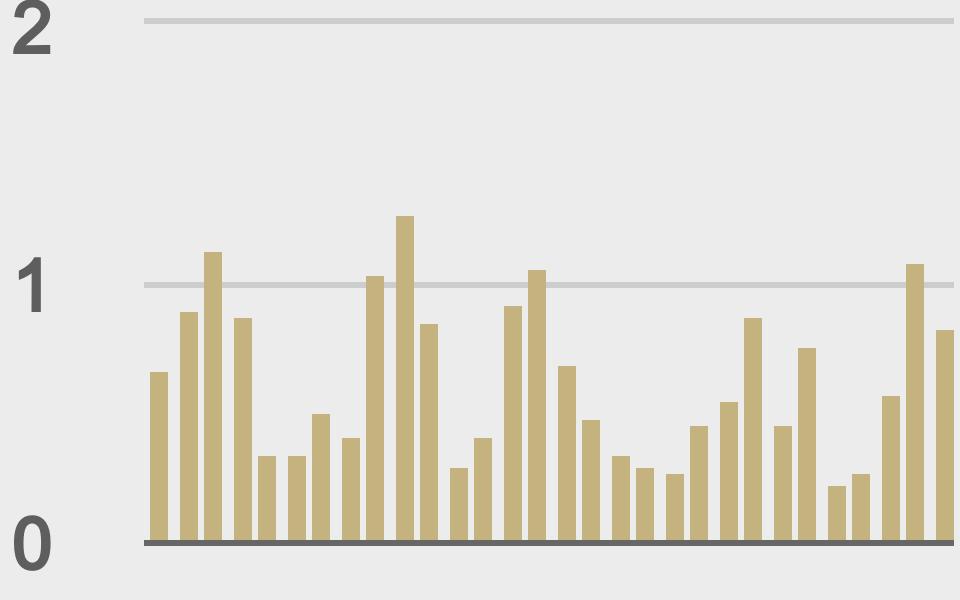

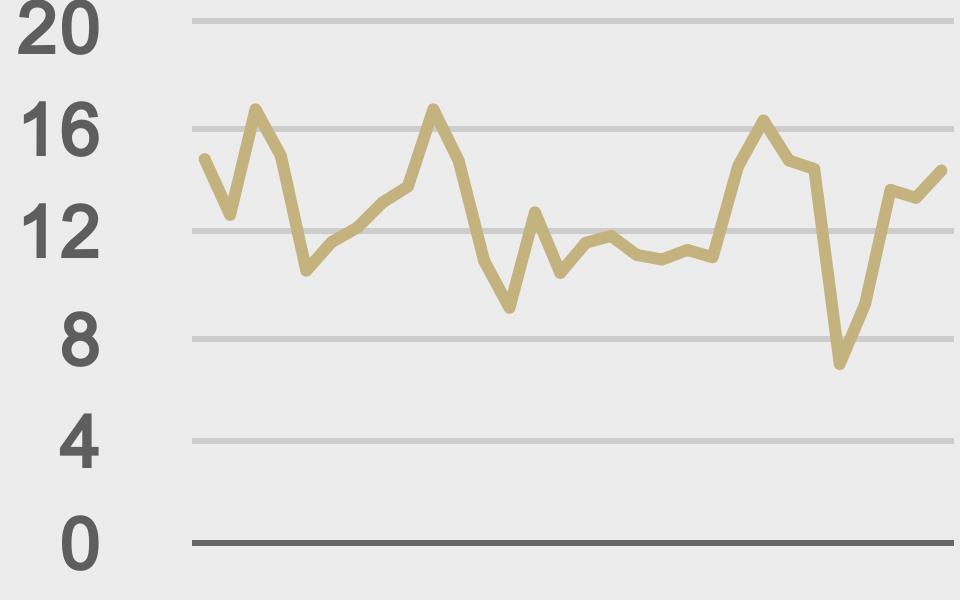

LMAX Digital volume pulled back from impressive gains in the previous session, but still managed to come in overall above 30-day average volume on Wednesday. Total notional volume for Wednesday came in at $1.4 billion, 6% above 30-day average volume. Bitcoin volume was the most impressive on Wednesday, 30% above 30-day average volume, coming in at $845 million. Ether volume moved in the opposite direction on Wednesday, slumping 16% below 30-day average volume, with a print of $340 million. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,615 and average position size for ether running up to $7,314. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $2,832 and $231 respectively. |

| Latest industry news |

|

There have been plenty of big crypto sponsorships in 2021, more evidence of the asset class going mainstream. The latest headline on this front came Wednesday, with news breaking that Crypto.com would be replacing the Staples Center as the new name for LA’s iconic arena. But overall, from a price action standpoint, there has been plenty of evidence of a tired market in recent sessions. As per today’s technical update, we do believe there is risk for a more significant correction if the bitcoin double top is triggered. Fundamentally, the chatter around increased odds of Fed Brainard becoming the next Fed Chair is not something that should sit well with crypto markets. Brainard hasn’t been very warm on crypto and is expected to support stiff regulatory guidelines. We’ve also been seeing more headlines out of China around its firmer stance against cryptocurrency. On Wednesday, many crypto sites and platforms were reported as being inaccessible. Finally, we’re concerned about potential weakness in the space resulting from a sharp move lower in US equities. US stocks have yet to see any meaningful pullback from record highs and we believe such a pullback would have a negative impact on crypto. |

| LMAX Digital metrics | ||||

|

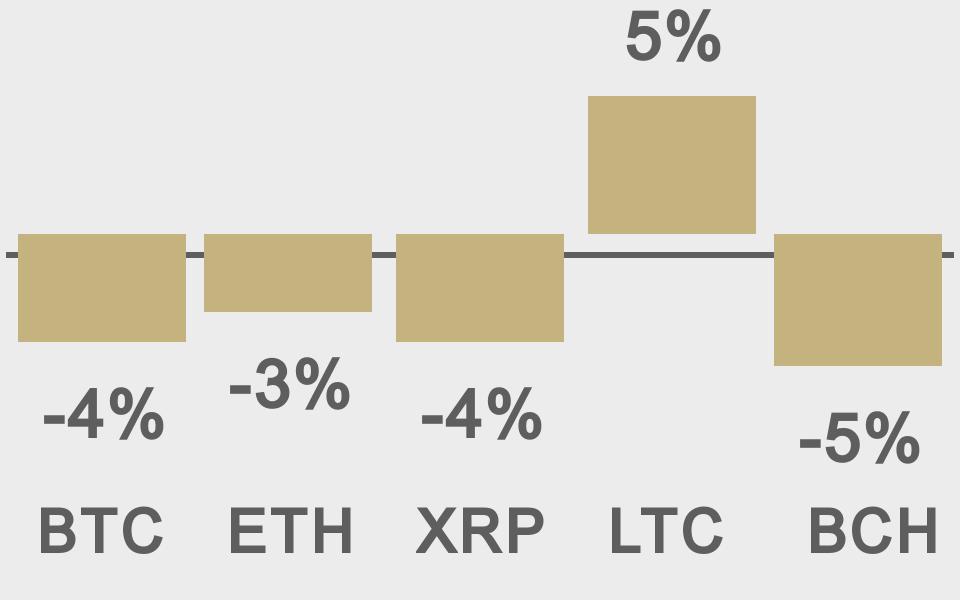

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@business |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||