|

|

5 March 2024 Still waiting for that fresh record high |

| LMAX Digital performance |

|

LMAX Digital volumes kicked off the week with a bang. Total notional volume for Monday came in at $1.5 billion, 149% above 30-day average volume. Bitcoin volume printed $1.1 billion on Monday, 193% above 30-day average volume. Ether volume came in at $262 million, 57% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $14,988 and average position size for ether at $3,910. Market volatility has been surging in recent days, exceeding the January peak and tracking to the highest levels since 2022. We’re looking at average daily ranges in bitcoin and ether of $2,517 and $135 respectively. |

| Latest industry news |

|

It’s hard to know exactly what the record high price of bitcoin was in 2021. But all that really matters is that the market believes that level to be $69,000, which means this is the level that will need to get convincingly taken out to officially signal we are in new territory. On Monday, the bitcoin run fell just short of $69,000 and we have since seen a minor pullback. The overwhelming expectation right now is that we should see a fresh record high in the sessions ahead. At the same time, our biggest concern continues to be the daily chart which shows bitcoin tracking in highly overbought territory and due for a deeper correction and consolidation before considering the next major upside extension. Ideally, we would see that fresh record high before the anticipated correction and consolidation. The market could then feel good about the fact that it has taken out the level and could relax and take a moment to catch its breath. Still, we can’t rule out the possibility that for the time being, that record high will hold and the correction is already underway. Technically speaking, if we do see the start to a correction, setbacks should be very well supported ahead of $45,000 and more optimally into the $50k area. As far as potential catalysts for said correction go, we believe the most likely is a Fed policy outlook that leans more hawkish and a resulting intensified downside pressure on US equities that weighs on global sentiment and spills over into crypto. Gains in US equities haven’t been nearly as impressive as crypto assets. But as far as traditional markets go, US equities have been on fire, pushing record highs and looking like they could be vulnerable to a capitulation event. Overall, our key takeaway right now is that as far as bitcoin and crypto go, everything looks great. But we have seen things perhaps run a little too far and fast and we wouldn’t be surprised to see some downside price action, before the market gets going again and bitcoin starts to make that next big push towards $100,000. Some positive highlights in recent days include Blackrock’s bitcoin ETF shattering records and hitting the milestone of $10 billion in assets under management in just seven weeks. This should only fuel more demand for bitcoin and more mainstream adoption. There’s also been some chatter that a recent large buyer of bitcoin could be the country of Qatar or Amazon founder Jeff Bezos. Finally, the surge in the price of bitcoin has on-chain metrics showing a remarkable 97% of bitcoin addresses in the money on their positions, the highest level since bitcoin’s record high month in November 2021. |

| LMAX Digital metrics | ||||

|

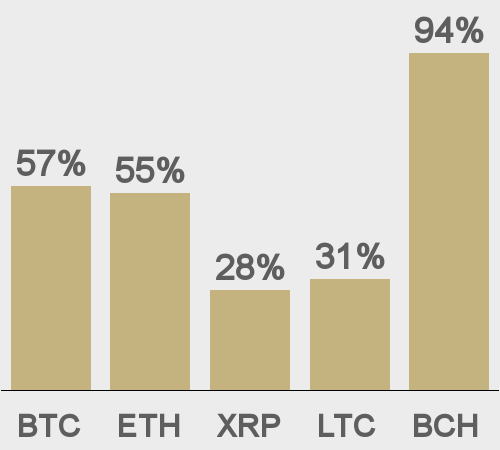

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

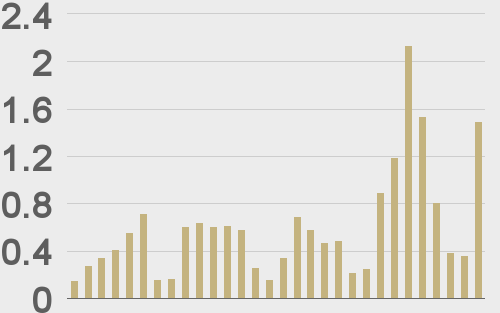

Total volumes last 30 days ($bn) |

||||

|

||||

|

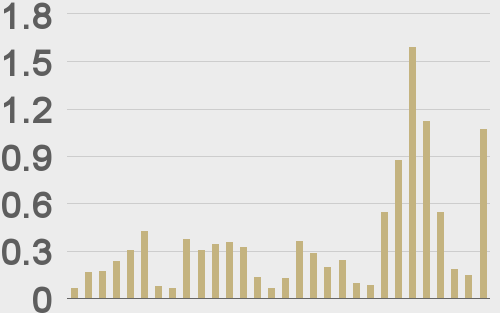

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

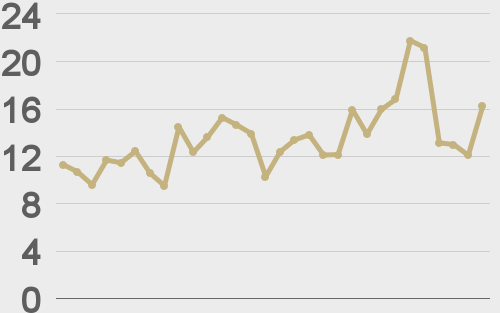

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

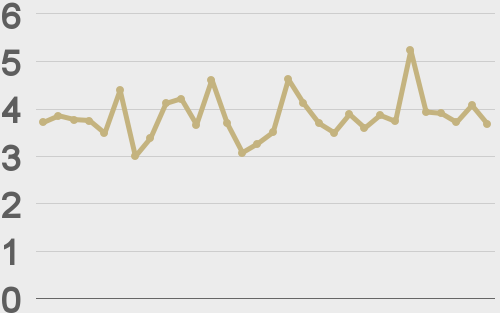

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||