|

|

14 December 2021 Telling signs from ETHBTC |

| LMAX Digital performance |

|

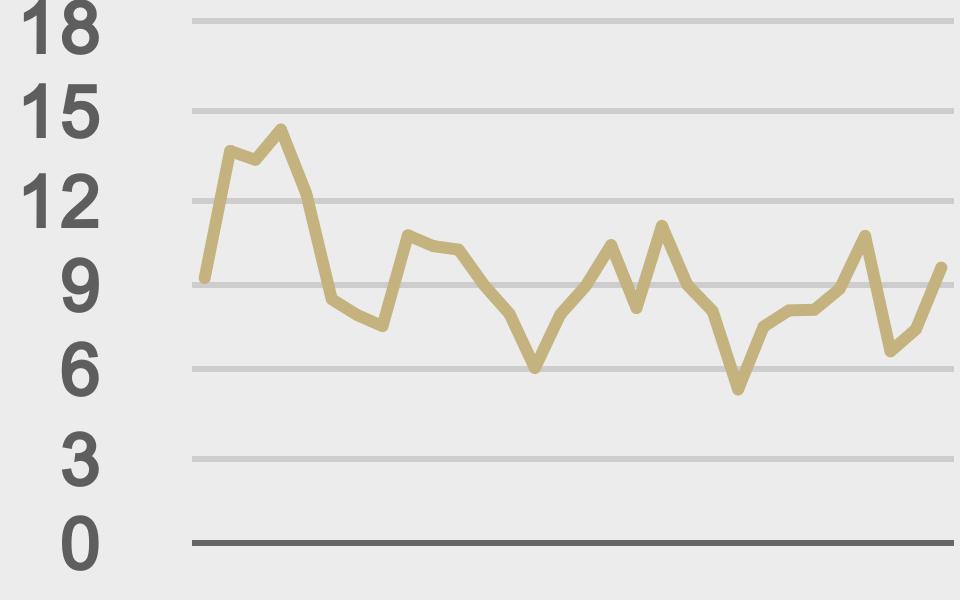

LMAX Digital volume got off to a good start this week, after a cool down in the previous week. Total notional volume for Monday came in at $1.43 billion, 19% above 30-day average volume. Bitcoin volume printed $751 million on Monday, 23% above 30-day average volume. Ether volume jumped to $506 million, 28% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,144 and average position size for ether at $8,129. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $3,182 and $309 respectively. |

| Latest industry news |

|

We’ve been keeping an eye on the ether to bitcoin ratio and the latest price action could be worrying. Last week, ether extended to a fresh multi-month high against bitcoin, reflective of a very bullish, risk-on feel in crypto markets. But in recent sessions, we’ve seen this market reverse course. The general view is that while ether is outperforming bitcoin, all is well in the crypto space, with the mood very much risk on given ether’s status as an innovation hub for web3. But as ether underperforms relative to bitcoin, it suggests the mood has shifted to one in which investors are more comfortable owning bitcoin over ether due to the safe haven, story of value draw of bitcoin. We’ve already highlighted our concern that Fed policy is moving in a less investor friendly direction and with the Fed decision due tomorrow, we are seeing some position squaring that has resulted in profit taking and risk off flow. As a consequence, this has flowed over into crypto assets, with the more risk correlated ether taking the harder hit. As we head into 2022, there is risk for a massive correction in US and global equities, which we do see as having a negative impact on a crypto market that has benefitted greatly from a decade plus risk environment that has fueled investment in alternative assets like crypto. And so, while our outlook remains highly constructive medium and longer-term, over the short-term, we would be on the lookout for deeper setbacks before we start heading higher again. |

| LMAX Digital metrics | ||||

|

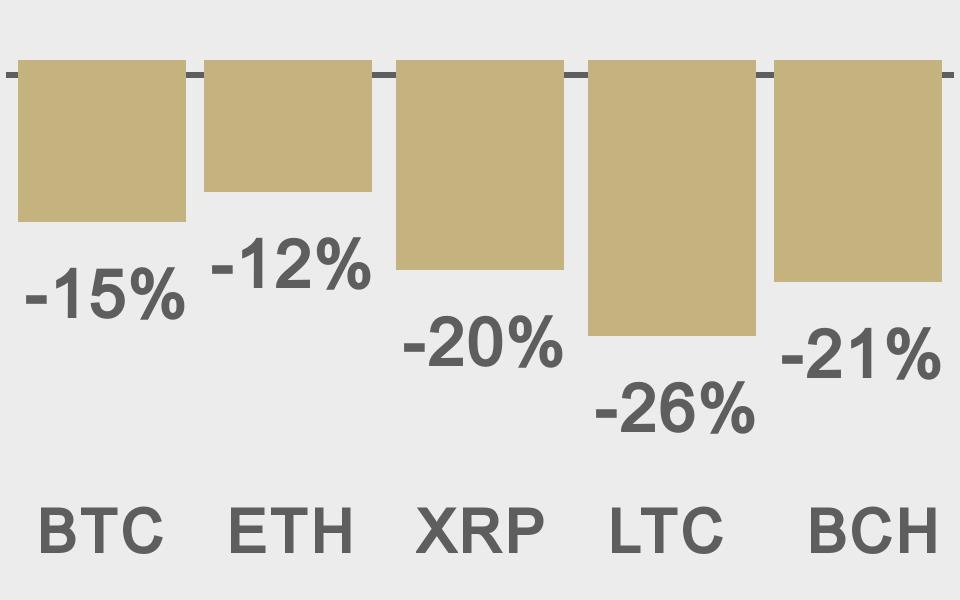

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

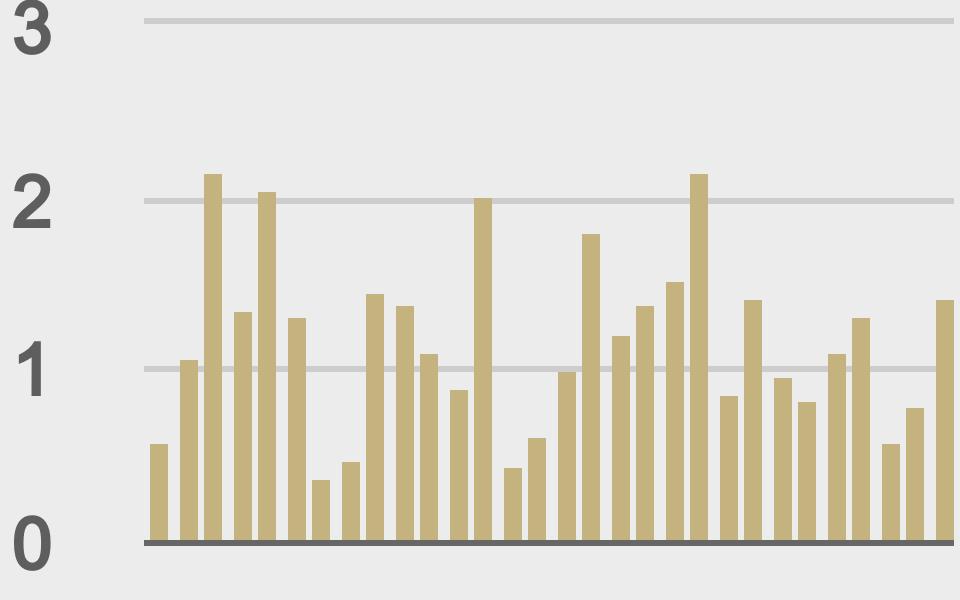

Total volumes last 30 days ($bn) |

||||

|

||||

|

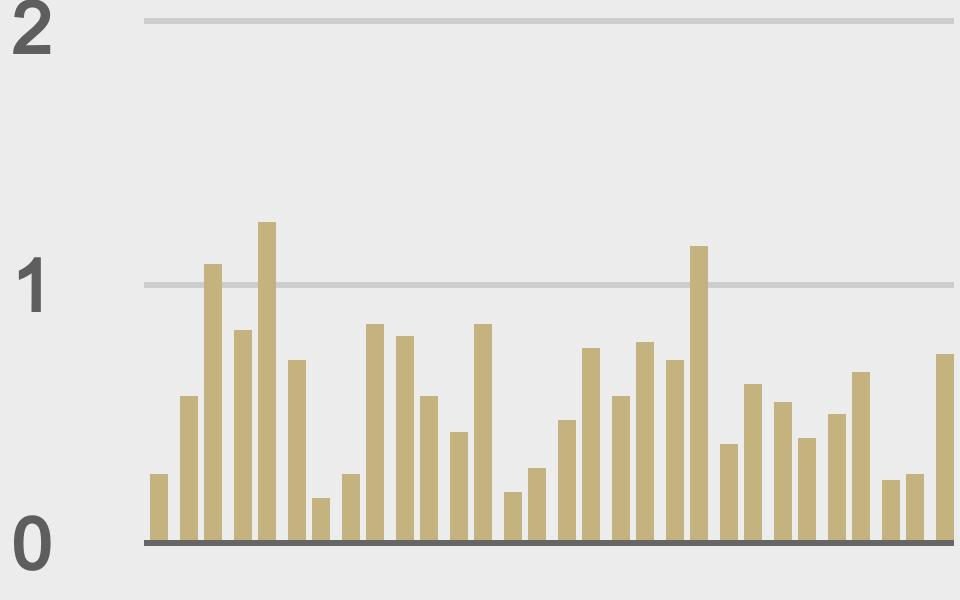

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

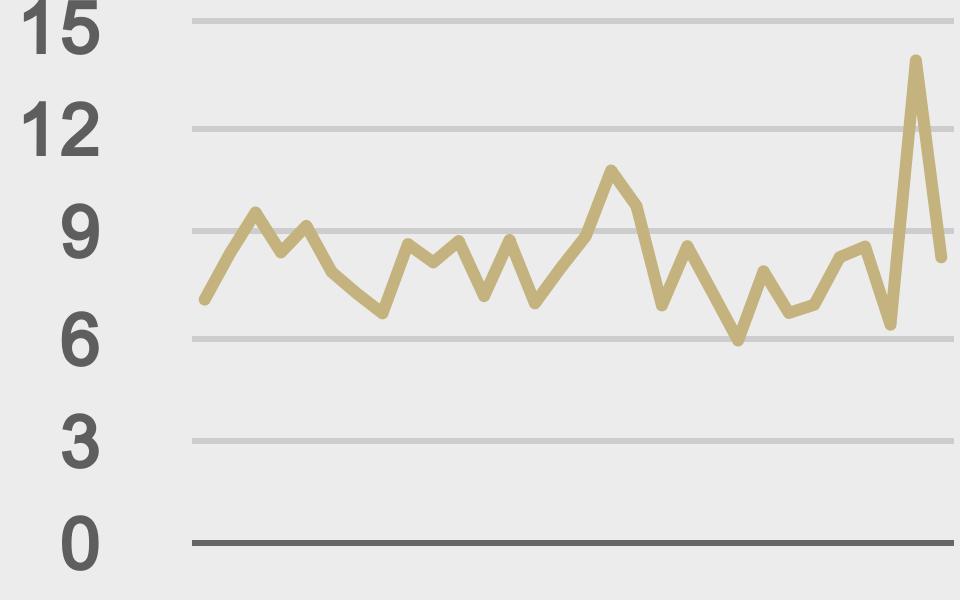

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@Bitcoin |

||||

|

@KaikoData |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||