|

|

21 December 2023 The many positive market drivers around bitcoin |

| LMAX Digital performance |

|

LMAX Digital volumes put in an impressive performance on Wednesday after a slow start to the week. Total notional volume for Wednesday came in at $839 million, 36% above 30-day average volume. Bitcoin volume printed $668 million on Wednesday, 40% above 30-day average volume. Ether volume came in at $111 million, 12% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $15,265 and average position size for ether at $3,410. Volatility has been trending just off yearly high levels set the other week. We’re looking at average daily ranges in bitcoin and ether of $1,538 and $91 respectively. |

| Latest industry news |

|

Bitcoin is holding true to seasonality trends as we come into the final days of liquid trade in December. The final month of the year has proven to be the third best performing month for bitcoin. Bitcoin has gained an average of 16% in Decembers going back to 2016, despite the two previous years producing negative returns. And thus far this month, bitcoin is tracking right with the average monthly return, currently up over 15% month-to-date. Technically speaking, it looks like bitcoin is consolidating ahead of the next big push to fresh yearly highs and towards major resistance in the $50k area. Fundamentally, there are a number of drivers behind the ongoing demand into year end. Anticipation around the bitcoin spot ETF approvals and support for higher prices around the halving event have already been highlighted ad nauseam. We’ve also noted a significant pickup in whale activity – those making purchases of at least $100k worth of bitcoin. And a report issued by a well known professional services network has revealed a pickup in interest around blockchain and cryptocurrency from family offices. Finally, the macro picture is arguably helping as well. Now that the market is pricing in an aggressive, investor friendly shift in Fed policy, there is a view that the more favorable risk climate will add to the overall interest in the emerging asset class. A Bank of America fund manager survey shows investor sentiment at its most upbeat since January 2022 as the market prices a soft landing, Goldilocks economy. |

| LMAX Digital metrics | ||||

|

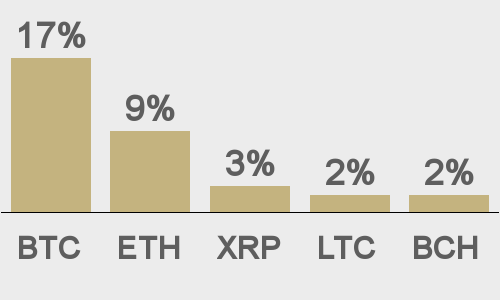

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

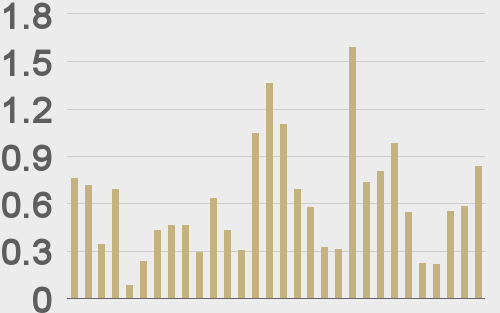

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

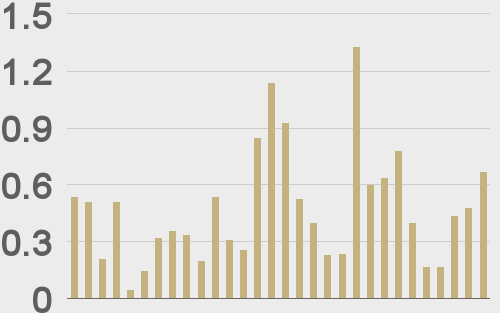

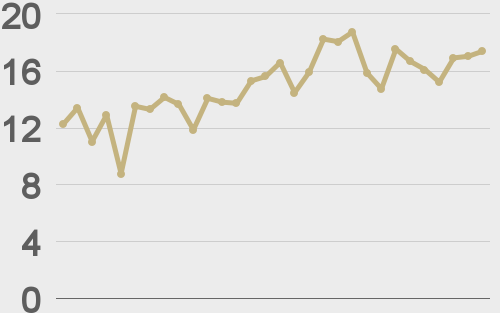

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

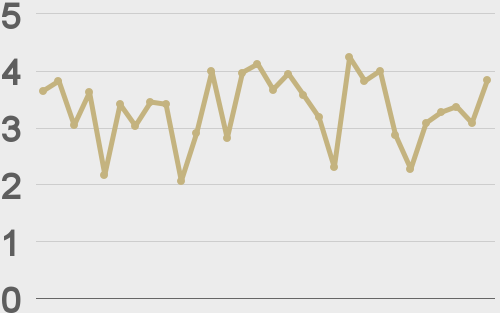

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||