|

|

11 December 2023 Three reasons for the Monday pullback |

| LMAX Digital performance |

|

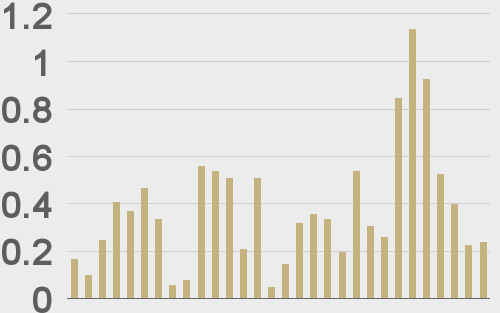

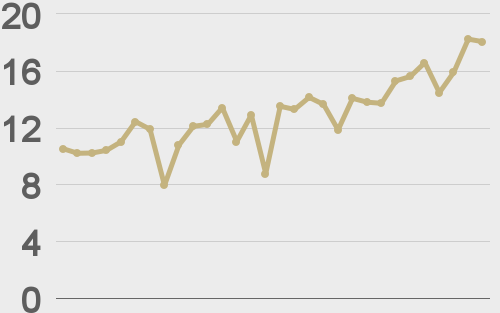

Total notional volume at LMAX Digital rocketed higher in the previous week, putting in the strongest performance of 2023, as activity picked up sharply into year end. Total notional volume from last Monday through Friday came in at $4.8 billion, 107% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $3.8 billion in the previous week, 118% higher than the week earlier. Ether volume came in at $661 million, 68% higher than the week earlier. Total notional volume over the past 30 days comes in at $15.9 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $13,400 and average position size for ether at $3,394. Volatility has been trending higher in recent months. Bitcoin volatility has traded it up to a fresh yearly high, while ether volatility is closing in on a retest of its yearly high level. We’re looking at average daily ranges in bitcoin and ether of $1,436 and $92 respectively. |

| Latest industry news |

|

The crypto market starts the new week under some pressure, though we aren’t all that concerned about the setbacks. At the moment, we see three major drivers behind the price action. The first driver is the fact that this is a market that had been in an intense uptrend in recent days, surging to fresh yearly highs. Bitcoin had traded up to $45k, while ether had exploded just over $2,400. Overbought readings were begging for some form of a pullback to allow for technical studies to unwind. The second driver is the fact that all of this pullback was made to be that much more aggressive as leveraged long positions were liquidated. Too many shorter-term traders had bitten off more than they could chew, leaving these position ripe for stop hunting and margin calls. Finally, there could be some macro fundamentals at play. Last Friday’s economic data out of the US came in strong as reflected through the jobs report and Michigan sentiment. The data forced investors to reprice Fed expectations, with the US Dollar rallying across the board. And so, a broad based rally in the US Dollar could be resulting in some cryptocurrency weakness. But overall, the outlook for crypto assets into year end remains bright. We suspect these dips in bitcoin and ether will be be eaten up rather quickly, in favor of higher lows and bullish continuations to new yearly highs. It’s worth noting, that if we pull things back, the picture is exceptionally constructive. Data shows that more than 57% of all bitcoin in circulation has not moved in the last two years. This means bitcoin positions were held from the record high at $69k all the way down to the $16k area 2022 low and back to current levels – an extremely bullish metric. |

| LMAX Digital metrics | ||||

|

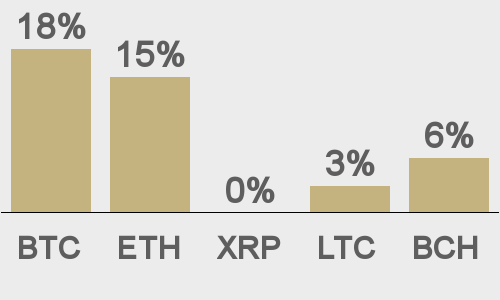

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

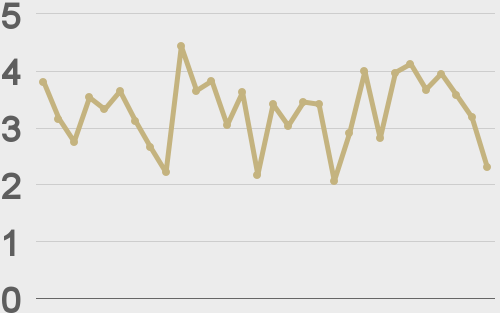

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||