|

|

9 March 2023 Traders worrying about more downside |

| LMAX Digital performance |

|

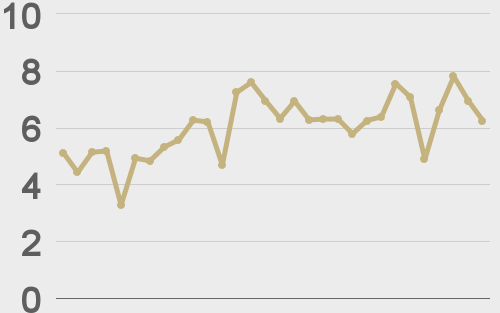

LMAX Digital volumes were down on Wednesday. Total notional volume for Wednesday came in at $287 million, 25% below 30-day average volume. Bitcoin volume printed $164 million on Wednesday, 22% below 30-day average volume. Ether volume printed $55 million, 47% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,095 and average position size for ether at 3,040. Volatility has come off recent highs but still sits well off multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $749 and $57 respectively. |

| Latest industry news |

|

We’ve been hearing reports of higher prices on bitcoin put options, which clearly suggests worry about the price continuing to slide and market participants looking to protect against this risk. The two major drivers this week have been around fallout at Silvergate and hawkish Fed testimony from the Fed Chair, both of which have had a weighing influence on crypto. Technically speaking, it does appear as though there is more room for weakness, with bitcoin staring at a retest of the February low, below which then exposes support in the form of the January 18 low, before the market then turns its attention to $20k. It’s possible, that we have seen most of this latest downside risk nearly fully priced in, leaving room for a bounce in the sessions ahead. Perhaps we get some economic data that has the market backtracking on hawkish Fed bets. Or perhaps there is some positive news out of the crypto space around feeling better about alternative existing solutions in place easily capable of accommodating any disruptions from Silvergate. Looking ahead, the final big event risk for the week comes into focus. This will be Friday’s US jobs report. If the report exceeds expectations, and produces another above forecast hourly earnings print, we could see more downside pressure on crypto. If on the other hand the report comes in below forecast and hourly earnings are softer, we could see a nice bounce in crypto as yield differentials move back out of the US Dollar’s favor. |

| LMAX Digital metrics | ||||

|

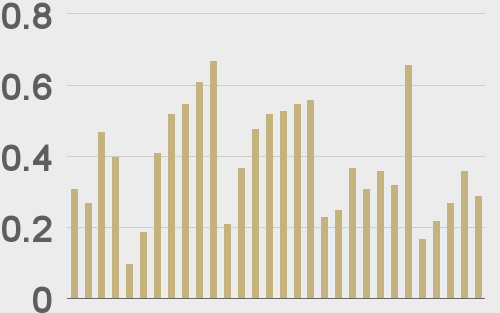

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

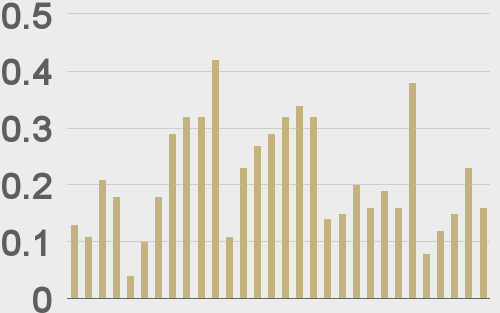

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

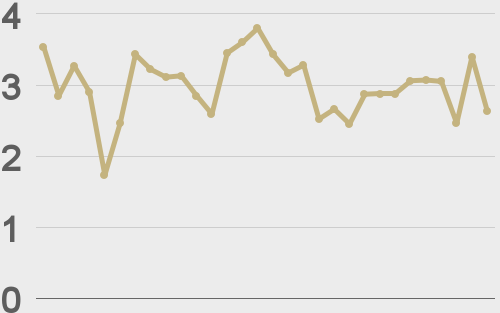

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||