|

|

10 May 2023 US inflation data comes into focus |

| LMAX Digital performance |

|

LMAX Digital volumes pulled back on Tuesday. Total notional volume for Tuesday came in at $351 million, 22% below 30-day average volume. Bitcoin volume printed $163 million on Tuesday, 39% below 30-day average volume. Ether volume printed $124 million, 2% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,665 and average position size for ether at 2,756. Volatility has been trending lower in correction mode after peaking out at a yearly high in March. We’re looking at average daily ranges in bitcoin and ether of $990 and $75 respectively. |

| Latest industry news |

|

Risk off flow in global markets has been weighing on crypto assets in recent sessions. And while the overall outlook for both bitcoin and ether remains constructive, it’s hard to ignore the possibility of a deeper pullback over the short-term. As per out technical analysis, the bitcoin daily chart is showing the possibility for a head & shoulders top. We’ve talked about the neckline coming in at $26,525, with a break below to open a measured move downside extension to $22,000. However, if such a move does play out, we fully expect strong buying interest to emerge down into the $22,000 area and well ahead of $20,000. As far as today goes, the key focus will be on the US inflation data. If the data comes out above forecast, look for more US Dollar demand on the yield differential implication, which would likely open risk off flow and more downside pressure on crypto. If on the other hand the inflation data comes in on the softer side of expectation, look out for renewed crypto demand and a push back to the topside in both bitcoin and ether. Finally, it’s worth highlighting a recent Goldman Sachs survey that shows the proportion of family offices invested in crypto up to 26% from 16% in 2021. |

| LMAX Digital metrics | ||||

|

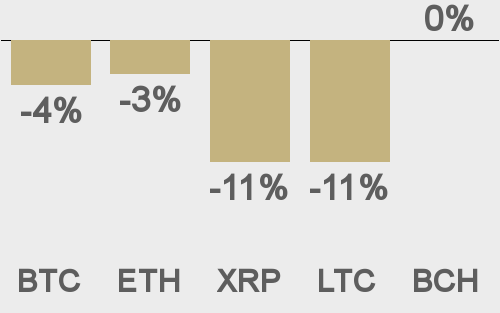

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

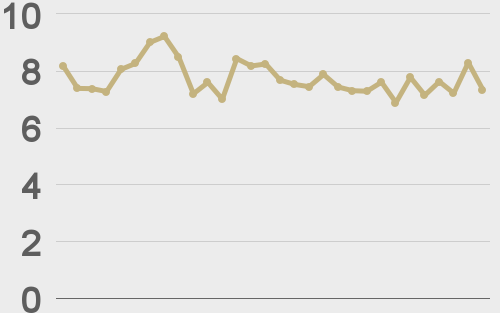

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||