|

|

9 December 2021 Volume and surveys point to price declines |

| LMAX Digital performance |

|

LMAX Digital volume has been on the decline this week. Total notional volume for Wednesday came in at $849 million, 31% below 30-day average volume. Bitcoin volume came in at $413 million, 34% below 30-day average volume. Ether volume was also down on Wednesday, at $243 million, 36% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,939 and average position size for ether at $7,853. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $3,278 and $303 respectively. |

| Latest industry news |

|

The heads of six major crypto firms sat down before the US House Financial Services Committee on Wednesday to discuss their views on regulation within the emerging space. Overall, the session was a success and should help to pave the way for more adoption into 2022. But shorter-term, as we’ve been highlighting, we think crypto assets are going to be more sensitive to developments in traditional markets, tracking with global risk sentiment. With that said, we are worried upside into the end of 2021 and early 2022 will be limited, with greater risk for deeper setbacks. The primary concerns are around a tighter, less investor friendly Fed policy outlook, and fallout from coronavirus that has yet to be fully felt by the global economy. We believe crypto will ultimately be very well supported into dips, but we do flag this shorter-term downside risk. This sentiment is also reflected in a Natixis survey of money managers that showed that crypto was ripe for a selloff next year, with respondents labelling digital assets as top contender for a major correction. At the same time, a third of those who invested planned to boost exposure in 2022 as well. |

| LMAX Digital metrics | ||||

|

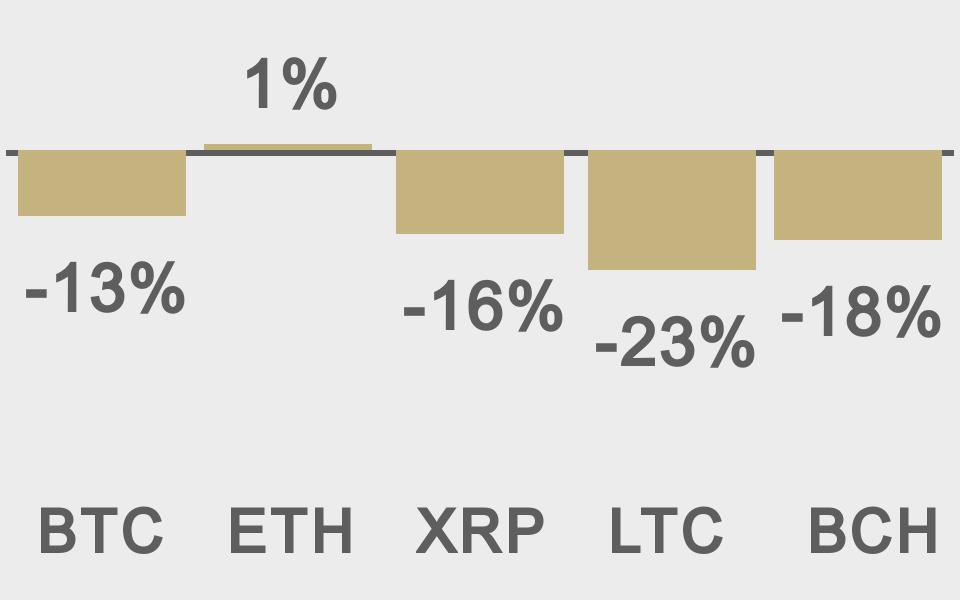

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

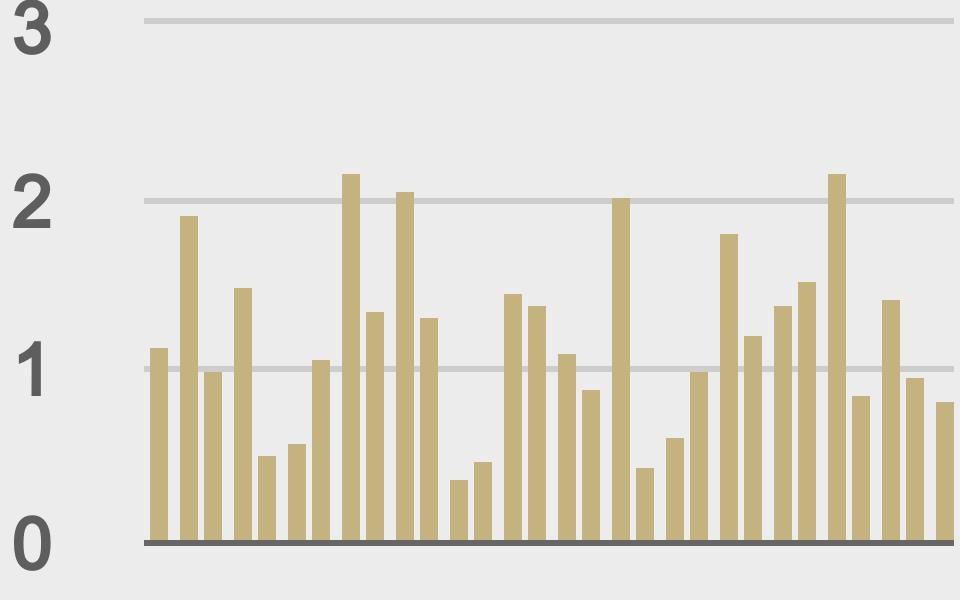

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

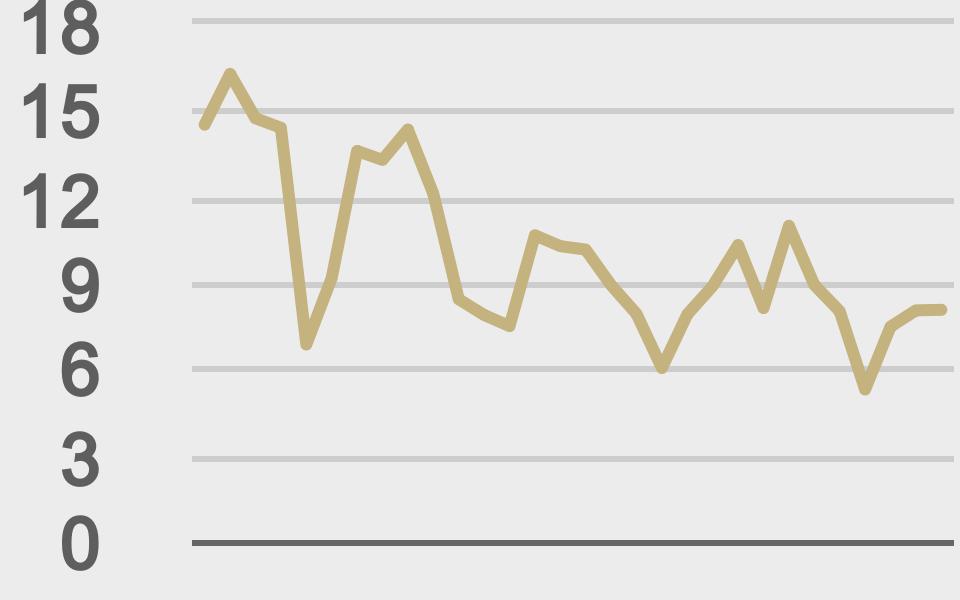

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

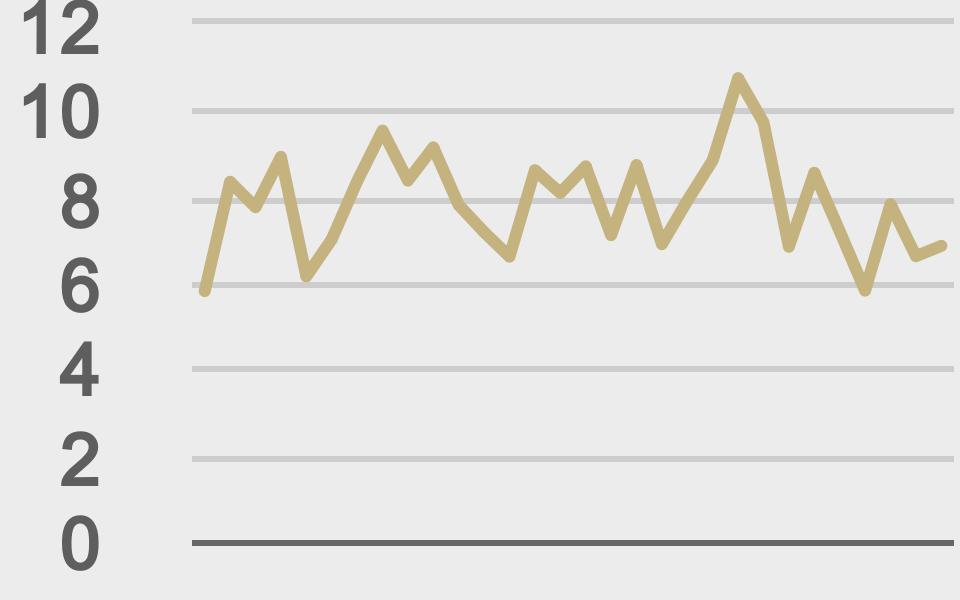

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@NTmoney |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||