|

|

16 January 2023 Volume continues to move in the right direction |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital continues to trend up in the new year and was up a nice amount in the previous week. Total notional volume from last Monday through Friday came in at $2.2 billion, 101% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.2 billion in the previous week, up 111% from a week earlier. Ether volume came in at $553 million, 134% higher from the week earlier. Total notional volume over the past 30 days comes in at $6.75 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,426 and average position size for ether at $2,062. Volatility is finally showing signs of turning up from multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $515 and $51 respectively. |

| Latest industry news |

|

It’s been a great start for crypto assets in 2023. Not only are we seeing an impressive surge in demand, we’re also seeing this surge accompanied by an uptick in volume. Fundamentally, the price action has mostly been attributed to the mood in traditional markets. Investor appetite has ramped up on account of peak inflation expectations, the China reopening, and an upgraded outlook for the Eurozone economy. And with risk assets running higher, so too has crypto on the back of this correlation that has crypto designated by many out there as a maturing, emerging market asset. Technically speaking, we are concerned that given the extent of the latest explosive run, we could be getting close to some form of a top in the sessions ahead. Bitcoin has rallied up into important resistance on the daily chart, and this coincides with a highly overbought daily RSI reading. This suggests the next big move could be lower rather than higher. Ultimately, we still wouldn’t rule out the possibility for another big drop in the price of bitcoin to fresh multi-month lows down towards $10k. A lot of this will have to do with the global outlook, fallout from crypto implosions in 2022, and the upcoming regulatory crackdown. At the same time, we are highly optimistic on the outlook for the space and in the event we did see such a setback in the first half of 2023, we believe additional weakness would be limited to the $10k in favor of the start to the next big push back towards the record high. |

| LMAX Digital metrics | ||||

|

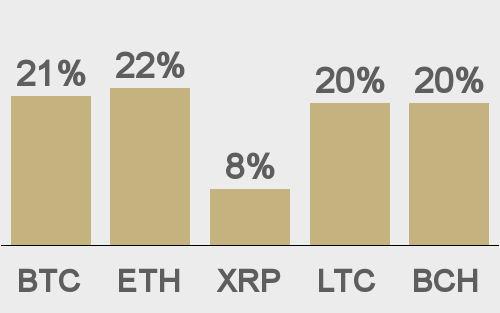

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

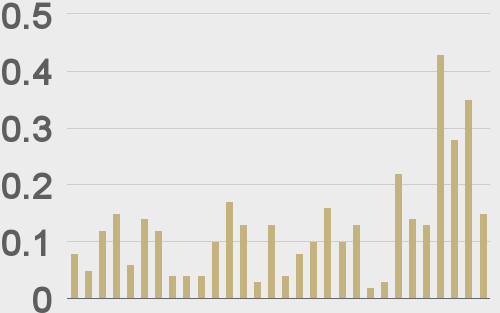

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||