|

|

8 June 2022 Volume jumps after slow start to week |

| LMAX Digital performance |

|

LMAX Digital volumes have been on the lower side of late, though we did see improvement on Tuesday after a very slow start to the week. Total notional volume for Tuesday was up 20% from the previous day. Nevertheless, volumes are still tracking well below 30-day average volume. Total notional volume for Tuesday came in at $545 million, 20% below 30-day average volume. Bitcoin volume printed $350 million on Tuesday, 17% below 30-day average volume. Ether volume came in at $110 million, 34% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,052 and average position size for ether at 3,625. There had been some signs of a pickup in volatility in May, though things have trended back down to yearly low levels in recent weeks. We’re now looking at average daily ranges in bitcoin and ether of $1,627 and $128 respectively. |

| Latest industry news |

|

Bitcoin has done a better job of holding up into setbacks than ether and the price action makes sense given ether’s stronger sensitivity to risk off flow. Having said that, both major cryptocurrencies are under pressure and at risk for another round of intense declines in the weeks ahead. The key level to watch right now is that $1,700 level in ether. Should we see a break below, it could act as that catalyst for the next big drop, opening the door for a retest of major previous resistance turned support in the form of the previous record high from 2018 around $1,400. We’ve talked a lot about how crypto markets have come under pressure due to the shift in central bank policy, which has ushered in a less investor friendly environment. And we’ve highlighted crypto’s correlation with risk assets given the fact that it is still a young and maturing market. But this week, we’ve also seen some added downside pressure on the back of the news that US regulators are investigating whether Binance broke securities rules when it sold digital tokens as the exchange was getting off the ground back in 2017. Binance’s BNB token is the 5th largest token and any fallout here would likely send shockwaves through the entire crypto market. On the positive side, a recent Reuters piece points to demand, citing a flow of funds back into listed cryptocurrency funds popular among institutional and retail players. This is a reversal from the outflows we were seeing from these funds back in April. |

| LMAX Digital metrics | ||||

|

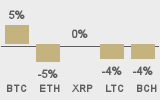

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

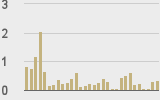

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

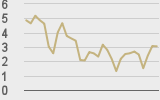

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||