|

|

8 February 2023 Volume up from a day earlier |

| LMAX Digital performance |

|

LMAX Digital volumes improved from Monday, but remained on the lighter side overall. Total notional volume for Tuesday came in at $306 million, 20% below 30-day average volume. Bitcoin volume printed $130 million on Tuesday, 35% below 30-day average volume. Ether volume was the positive outlier for the day, coming in at $107 million, 7% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,145 and average position size for ether at 2,952. Volatility is finally showing signs of turning up from multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $687 and $66 respectively. |

| Latest industry news |

|

There haven’t been many major updates from the crypto front, and most of the movement we’re seeing is movement in lock step with the stock market. And so, the recovery in stocks on Tuesday has helped to open renewed demand for crypto assets into this latest dip. Though the Fed Chair was still talking hawkish on Tuesday, the market once again chose to only focus on the dovish aspects. Technically speaking, we’re in a tough spot as far as being able to determine the next big move. On the one side, the market could be consolidating ahead of the next push to test major resistance up in the form of the August 2022 high at $25,220. On the other side, it’s possible we’ve already seen the market top out following an explosive run in January, with the price seen on the verge of rolling over for a pullback that takes us back towards and potentially below $20,000. So for now, it will be worth paying attention to short-term resistance and support for a better indication. On the topside, the focus will be on $24,265. On the downside, the focus will be on $22,300. Anything in between is just considered to be choppy, directionless trade. |

| LMAX Digital metrics | ||||

|

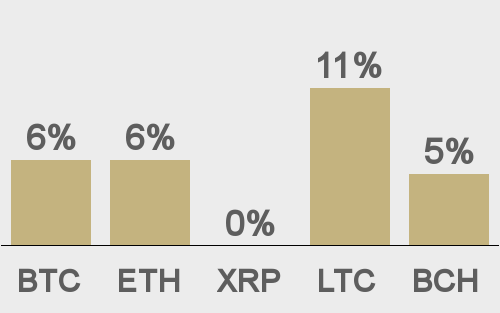

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

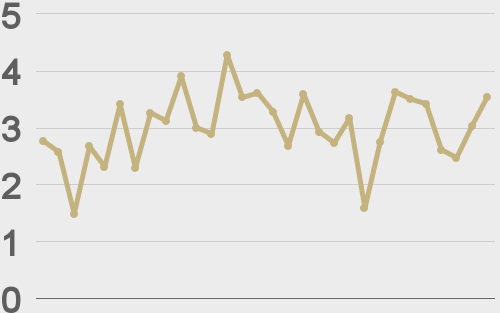

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||