|

|

23 May 2022 Volumes cool off after big week |

| LMAX Digital performance |

|

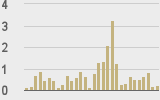

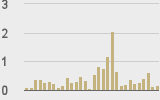

Total notional volume at LMAX Digital was off considerably in the previous week after seeing the highest daily volumes of the year a week earlier. Total notional volume from Monday through Friday came in at $3.1 billion, 66% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $2 billion in the previous week, off 64% from a week earlier. Ether volume dipped down to just $716 million, off 72% from the week earlier. Total notional volume over the past 30 days comes in at $21.4 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,349 and average position size for ether at $4,876. Volatility has been showing signs of wanting to pick back up after a period of extreme low volatility for much of 2022. We’re now looking at average daily ranges in bitcoin and ether of $1,908 and $161 respectively. |

| Latest industry news |

|

Things have been relatively quiet in the world of crypto in recent sessions. What we’re seeing is consolidation ahead of whatever that next move will be. At the moment, given the recent trend of bearish momentum, we suspect this could lead to deeper setbacks. Technically speaking, the big level to pay attention to is that previous record high in bitcoin from back in 2017. This level, which comes in around $20,000, now acts as the next meaningful level of support and a massive previous resistance turned support. Given the fundamental backdrop, which continues to show crypto correlating with risk off flow, we see room for things to play out this way, with global risk appetite waning and market participants looking to move into safer assets. While we see bitcoin as a flight to safety play given the longer-term value proposition, at the moment, it is still considered to be a maturing asset, which likens it to a risk correlated emerging market. At the same time, once we do finally see a breakdown to test the $20,000 barrier, we then see bitcoin and other crypto assets being very well supported even if stocks continue to decline. |

| LMAX Digital metrics | ||||

|

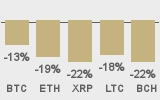

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@economics |

||||

|

@punk9059 |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||