|

|

28 December 2022 Volumes pick up despite thin conditions |

| LMAX Digital performance |

|

LMAX Digital volumes were up a healthy amount on Tuesday, despite the thin holiday trade. Total notional volume for Tuesday came in at $194 million, 8% above 30-day average volume. Bitcoin volume printed $103 million on Tuesday, 6% below 30-day average volume. Ether volume came in at $66 million, 75% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,189 and average position size for ether at 1,652. Volatility has been anemic in 2022, and after seeing a little pick-up in recent weeks, we’re right back down to yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $383 and $45 respectively. |

| Latest industry news |

|

We haven’t seen much activity in markets this week and we don’t expect to see all that much until markets return to fuller form next week. But overall, crypto assets remain well offered into rallies and the shorter-term outlook points to additional setbacks. The macro backdrop continues to suggest turbulence into Q1 2023 on account of shifting central bank policy that leans to a less investor friendly trajectory. We also expect more bumps in the road on fallout from the FTX debacle. On a positive note, Japan’s Financial Services Agency is reconsidering its stance on stablecoins, after it was one of the first countries to limit the issuance of stablecoins to regulated entities in the aftermath of the Terra collapse. Technically speaking, we’ve been highlighting risk for bitcoin to extend declines down to test $10k in Q1 2023. This follows the November breakdown below the previous yearly low at $17,600. Another short-term bearish technical note is the fact that we have yet to see ether break to a fresh yearly low despite the bitcoin breakdown to its own fresh yearly low in November. We believe ether will need to take out the 2022 low before a longer-term bottom can be established. Having said this, the medium and longer-term outlook remains exceptionally constructive and the next healthy decline, possibly into the bitcoin $10k area, will likely signal an imminent bottom ahead of the next big run to the topside. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

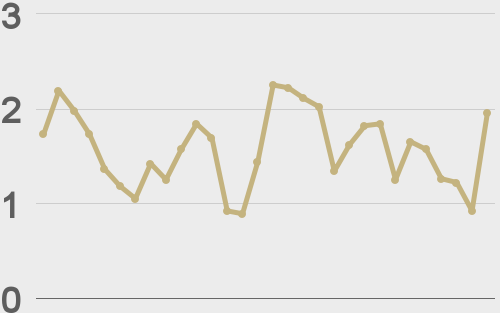

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||