|

|

19 June 2023 Volumes up in previous week |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital improved in the previous week. Total notional volume from last Monday through Friday came in at $2.1 billion, 7% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.2 billion in the previous week, 15% higher than the week earlier. Ether volume however declined, coming in at $605 million, 6% lower than the week earlier. Total notional volume over the past 30 days comes in at $9.3 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,693 and average position size for ether at $2,853. Volatility is showing signs of picking back up in recent sessions after trading down to the lowest levels since earlier this year. We’re looking at average daily ranges in bitcoin and ether of $828 and $58 respectively. |

| Latest industry news |

|

The week will get off to a quiet start with US markets less active on active of the holiday session. Overall, the crypto market has taken the latest regulatory shakeup in stride and has managed to find some formidable support into dips. Technically speaking, we’ve talked about the outlook remaining constructive despite the negative headlines, with bitcoin in the process of looking for that next higher low above the 2022 low in favor of a bullish continuation and the next major upside extension. Our biggest concern over the short-term is the fact that the stock market has been rocketing higher in recent days, pushing to fresh yearly highs, all while cryptocurrencies have been contending with some struggles on account of the regulatory uncertainty. The reason we’re so concerned is that stocks could once again be at risk for a major pullback. And if this plays out, there is a decent chance it would have a weighing influence on crypto assets. The fundamental catalyst here is the Fed outlook and the market waking up to the fact that as much as it would like to price in a less aggressive Fed, this has not been the case, with the central bank committed to the possibility of higher rates. And as things stand, should we see higher rates, yield differentials will move in favor of the US Dollar, risk sentiment will come off and there will be risk that cryptocurrencies get hit on all of this. Having said that, price action in crypto has been looking up in recent sessions, and there is also the chance that cryptocurrencies do their own thing and pay little attention to any turbulence in equities. After all, as crypto assets mature, the case for a disconnect in the correlation with traditional risk sentiment should become stronger and stronger. The idea of bitcoin as a limited supply, safe haven asset is one that we believe will gain more traction. Whether or not we’re there yet remains in question. |

| LMAX Digital metrics | ||||

|

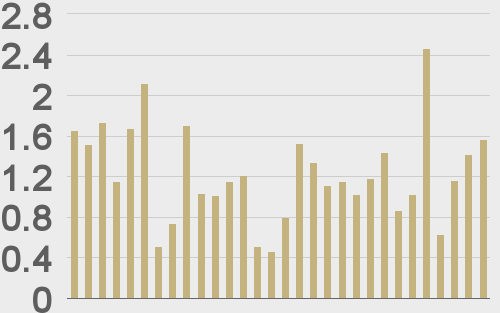

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

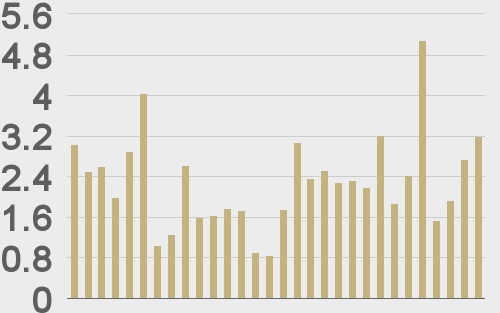

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

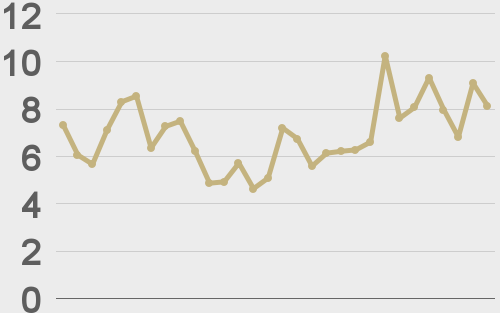

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

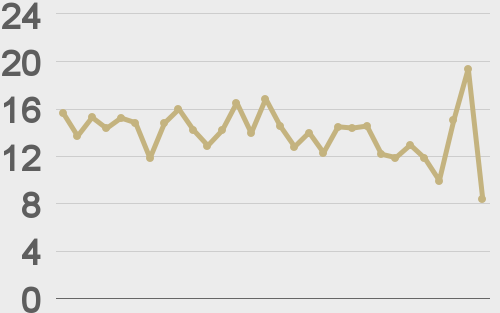

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||